94 /

Atul Ltd

|

Annual Report 2009-10

19

Employee benefits (contd)

19 Employee benefits (contd)

(a) Defined benefit plans (contd):

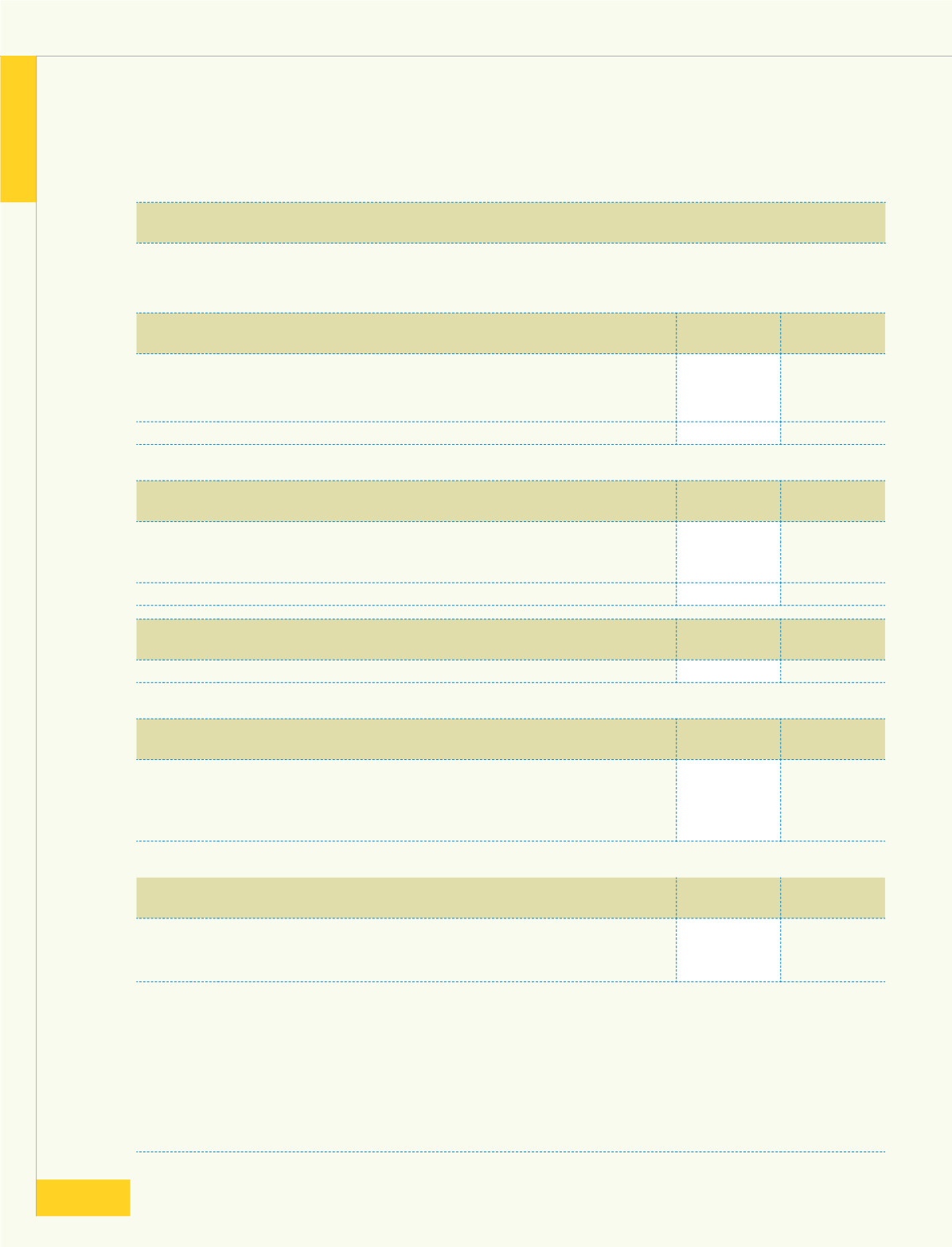

Net asset | (liability) recognised in the Balance Sheet as at March 31, 2010

Particulars

Gratuity

funded

Gratuity

funded

1 Present value of defined benefit obligation

30.55

26.16

2 Fair value of plan assets

30.81

26.16

3 Funded status (surplus | (deficits))

0.26

(0.35)

Net assets | (liability)

0.26

(0.35)

Reconciliation of net assets | (liability) recognised in the Balance Sheet as at March 31, 2010

Particulars

Gratuity

funded

Gratuity

funded

1 Net assets | (liability) at beginning of the year

(0.38)

0.17

2 Employer expenses

2.59

3.61

3 Employer contribution

(1.95)

3.44

Net assets | (liability) at the end of the year

0.26

7.22

Particulars

Gratuity

funded

Gratuity

funded

Actual return on plan assets

4.81

0.04

Actuarial Assumptions

Particulars

Gratuity

funded

Gratuity

funded

1 Discount rates

8.25%

7.50%

2 Expected rate of return on plan asset

8.00%

8.00%

3 Expected rate of salary increase

6.50%

5.00%

4 Mortality post- retirement

LIC (1994-96) LIC (1994-96)

Major category of plan asset as a percentage of total plan

Particulars

Gratuity

funded

Gratuity

funded

1 Unit linked insurance plan of various private insurance companies

approved by IRDA

94%

94%

2 In approved government securities

6%

6%

(b) Defined contribution plan:

Amount of Rs 5.93 crores (Previous year Rs 5.73 crores) is recognised as expense and included in the Schedule

13 " Contribution to Provident and Other Funds" to the Profit and Loss Account.

(c) The estimates of future salary increases, considered in actuarial valuation, take account of inflation, seniority,

promotion and other relevant factors, such as supply and demand in the employment market. Mortality rates

are obtained from the relevant data.

(d) Amount recognised as an expense in respect of Compensated Leave Absences in Rs 2.21 crores (Previous year

Rs 3.00 crores).

(Rs crores)

SCHEDULE 16 NOTES FORMING PART OF THE ACCOUNTS

(contd)

2009-10

2008-09

Schedule

forming part of the accounts

95