Corporate Identity Serving Diverse Industries Purpose and Values Overview by the Chairman Operational Highlights Financial Analysis Research and Technology

Safety, HealthandEnvironment Serving the Society Directors’ Report Management Discussion andAnalysis Report on Corporate Governance

Financial Statements

(c) Financial Derivatives Hedging Transactions:

Pursuant to the announcement issued by The Institute of Chartered Accountants of India dated March 29, 2008

in respect of forward exchange contracts and currency and interest rate swaps, the Company has applied the

Hedge Accounting principles set out in the Accounting Standard (AS) 30 'Financial Instruments : Recognition and

Measurement'. Accordingly, Range Forward Contracts are marked to market and the loss aggregating Rs 15.03

crores arising consequently on contracts that were designated and effective as hedges of future cash flows has

been recognised directly in the Hedging Reserve Account. Actual gain or loss on exercise of these Range Forward

contracts or any part thereof is recognised in the Profit and Loss Account. Hedge accounting will be discontinued

if the hedging instrument is sold, terminated or no longer qualifies for hedge accounting.

17 Significant accounting policies followed by the Company are as stated in the statement annexed to this Schedule.

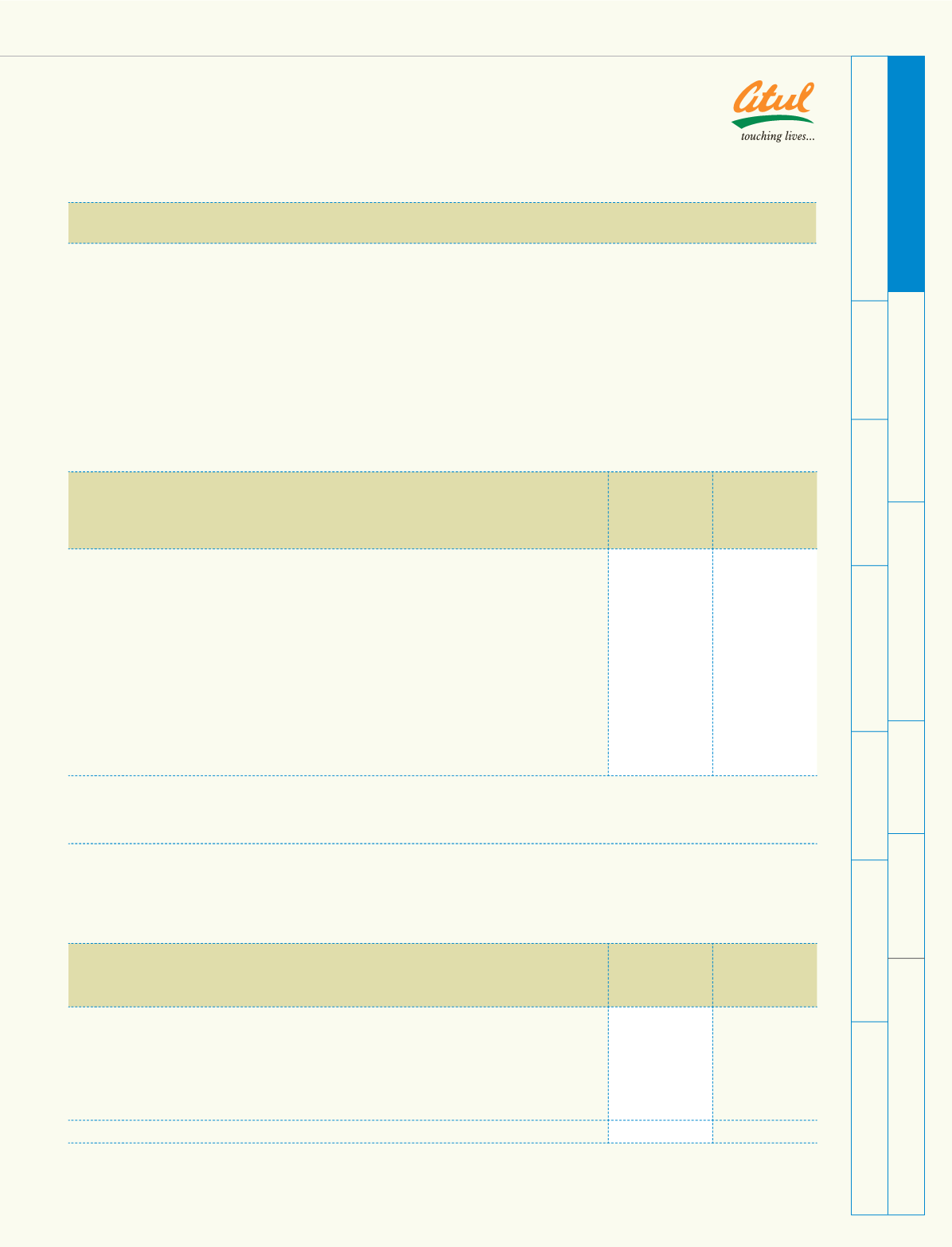

18 Loans and advances in nature of loans

(Rs crores)

Particulars

Amount

outstanding

As at March

31, 2010

Maximum

balance

During the

year

(i) Subsidiary:

Ameer Trading Corporation Ltd (including interest)

5.66

8.23

(ii) Associate companies:

AtRo Ltd (a) - Rs 1,500

Amal Ltd (including interest)

21.29

22.42

(iii) Loan to others where there is no interest or repayment schedule:

Atul club

1.36

1.36

Atul Retail Brands Pvt Ltd - Rs 5,300

-

Atul Rajasthan Date Palms Ltd - Rs 43,871

-

Atul Solar Energy Pvt Ltd - Rs 5,300

-

Note:

(a) No repayment Schedule.

(b) Loans given to employees as per the policy of the Company are not considered.

19 Employee benefits

(a) Defined benefit plans:

Expenses recognised for the year ended on March 31, 2010

(included in Schedule 13 of Profit and Loss Account)

(Rs crores)

Particulars

2009-10

2008-09

Gratuity

funded

Gratuity

funded

1 Current service cost

1.38

1.34

2 Interest cost

2.06

1.96

3 Expected return on plan assets

(2.21)

(2.19)

4 Employer contribution (receipt)

0.00

-

5 Actuarial losses | (gains)

0.84

2.33

Expenses recognised in Profit and Loss Account

2.07

3.44

Schedule

forming part of the accounts

SCHEDULE 16 NOTES FORMING PART OF THE ACCOUNTS

(contd)