Note 28.4 Related party disclosures (continued)

(

`

cr)

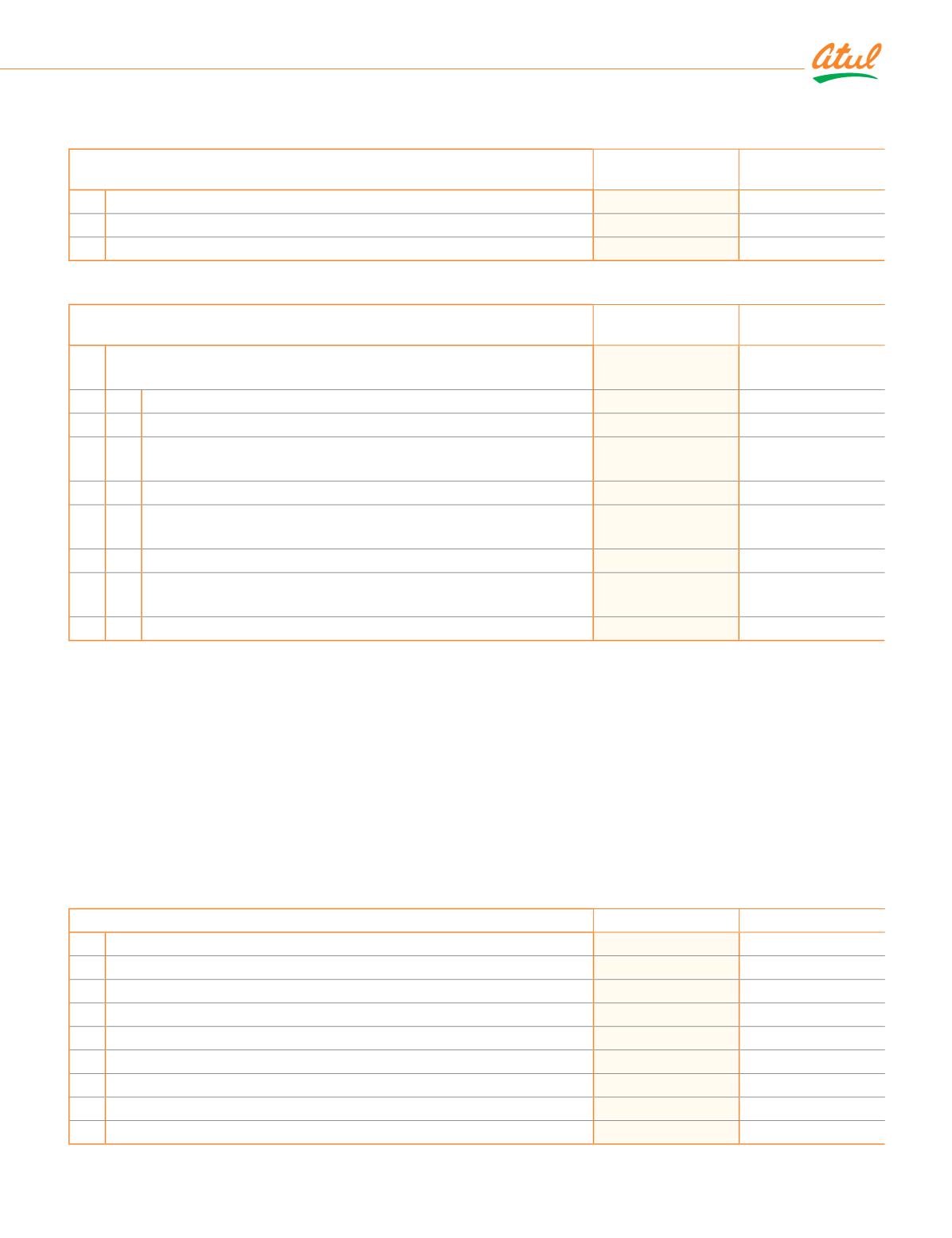

Note 28.4 (I) Outstanding balances as at year end

As at

March 31, 2019

As at

March 31, 2018

d) With Key Management Personnel

Payables

-

0.01

Directors’ deposit

-

0.01

(

`

cr)

Note 28.4 (e) Outstanding balances as at year end

As at

March 31, 2019

As at

March 31, 2018

e) With entities over which Key Management Personnel or their close

ljîŞĿŕNj ŞĚŞċĚƑƙ ĺîDŽĚ ƙĿijŠĿǛČîŠƥ ĿŠǜƭĚŠČĚ

1 Receivables

0.03

0.07

ƥƭŕ eĚŕîDŽîŠĿ qîŠēîŕ ȳ ƭƑƑĚŠƥ ƎĚƑĿūēȠ

`

ǪǫȡǮǦǪȴ

0.05

Atul Rural Development Fund (Current year:

`

ǪǧȡǨǭǬ îŠē ¡ƑĚDŽĿūƭƙ

year:

`

ǨǫȡǫǬǪȴ

Atul Vidyalaya

0.03

0.02

ÀƑŞĿ ¬ƥƑĚĚ ¬îŠƙƥĺî ȳ ƭƑƑĚŠƥ NjĚîƑȠ

`

ǨǧȡǯǧǪ îŠē ¡ƑĚDŽĿūƭƙ NjĚîƑȠ

`

7,199)

2 Payables

0.02

Atul Rural Development Fund (Current year:

`

15,000 and Previous

year:

`

12,500)

Atul Vidyalaya

0.02

-

Note 28.4 (J) Terms and conditions

1

Sales to and purchases from related parties were made on normal commercial terms and conditions and at prevailing

market prices or where market price is not available, at cost plus margin.

2

Transactions relating to dividends were on the same terms and conditions that applied to other shareholders. Subscriptions

for new equity shares were on preferential basis.

3

All outstanding balances are unsecured and are repayable in cash and cash equivalent.

Note 28.5 Current and deferred tax

The major components of income tax expense for the years ended March 31, 2019 and March 31, 2018 are:

îȴ TŠČūŞĚ ƥîNJ ĚNJƎĚŠƙĚ ƑĚČūijŠĿƙĚē ĿŠ ƥĺĚ ¬ƥîƥĚŞĚŠƥ ūlj ¡ƑūǛƥ ūƑ gūƙƙȠ

(

`

cr)

Particulars

2018-19

2017-18

i)

Current tax

ƭƑƑĚŠƥ ƥîNJ ūŠ ƎƑūǛƥ ljūƑ ƥĺĚ NjĚîƑ

235.88

ǧǦǩȦǦǪ

Adjustments for current tax of prior periods

0.87

(0.83)

Total current tax expense

236.75

102.21

ii) Deferred tax

(Decrease) | Increase in deferred tax liabilities

ȳǨȦǪǩȴ

1.59

Decrease | (Increase) in deferred tax assets

(11.06)

ǨǩȦǦǪ

¹ūƥîŕ ēĚljĚƑƑĚē ƥîNJ ĚNJƎĚŠƙĚ ʈ ȳċĚŠĚǛƥȴ

(13.49)

24.63

Income tax expense

223.26

126.84

155

Standalone

|

Notes to the Financial Statements