Note 28.5 Current and deferred tax (continued)

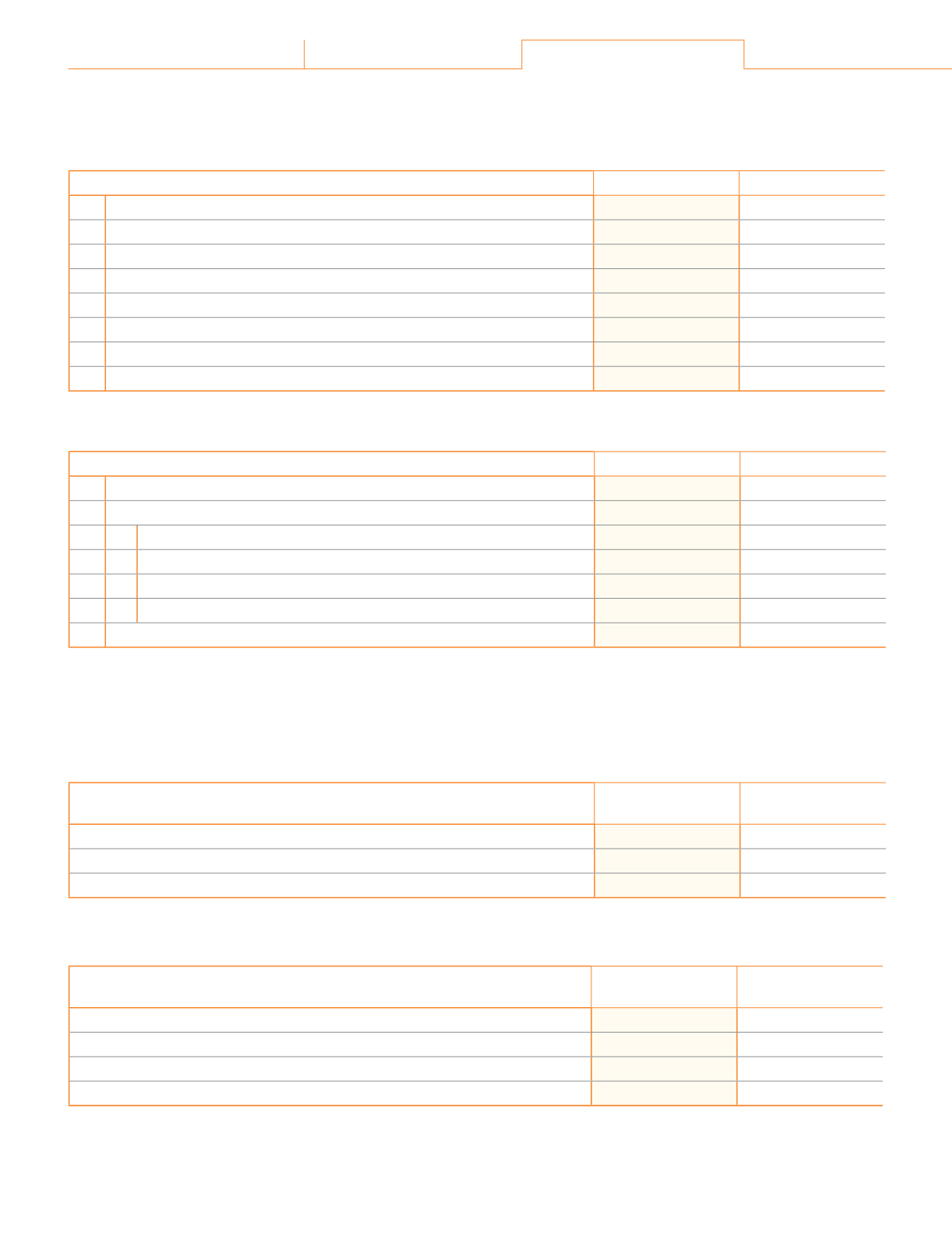

b) Income tax expense recognised in the Statement of other comprehensive income:

(

`

cr)

Particulars

2018-19

2017-18

i)

Current tax

¤ĚŞĚîƙƭƑĚŞĚŠƥ ijîĿŠ ʈ ȳŕūƙƙȴ ūŠ ēĚǛŠĚē ċĚŠĚǛƥ ƎŕîŠƙ

(0.13)

0.95

Total current tax expense

(0.13)

0.95

ii) Deferred tax

Fair value equity investment

11.00

-

/ljljĚČƥĿDŽĚ ƎūƑƥĿūŠ ūlj ijîĿŠ ʈ ȳŕūƙƙȴ ūŠ Čîƙĺ ǜūDž ĺĚēijĚƙ

ǦȦǪǩ

0.02

¹ūƥîŕ ēĚljĚƑƑĚē ƥîNJ ĚNJƎĚŠƙĚ ʈ ȳċĚŠĚǛƥȴ

11.43

0.02

Income tax expense

11.30

0.97

c) The reconciliation between the statutory income tax rate applicable to the Company and the effective income tax

rate of the Company is as follows:

Particulars

2018-19

2017-18

a)

Statutory income tax rate

ǩǪȦǯǪɼ

ǩǪȦǬǧɼ

b)

Differences due to:

i)

Non-deductible expenses

0.27%

0.35%

ii) Exempt income

ȳǦȦǪǦɼȴ

ȳǧȦǪǬɼȴ

iii) Income tax incentives

(0.61%)

ȳǦȦǮǪɼȴ

iv) Others

0.05%

(0.75%)

Effective income tax rate

34.25%

31.91%

¹ĺĚ îƎƎŕĿČîċŕĚ ƙƥîƥƭƥūƑNj ĿŠČūŞĚ ƥîNJ ƑîƥĚ ljūƑ ƥĺĚ NjĚîƑ ĚŠēĚē qîƑČĺ ǩǧȡ ǨǦǧǯ îŠē qîƑČĺ ǩǧȡ ǨǦǧǮ Ŀƙ ǩǪȦǯǪɼ îŠē ǩǪȦǬǧɼȡ

ƑĚƙƎĚČƥĿDŽĚŕNjȦ ¹ĺĚ ĿŠČƑĚîƙĚ ĿŠ ƥĺĚ ČūƑƎūƑîƥĚ ƙƥîƥƭƥūƑNj ĿŠČūŞĚ ƥîNJ ƑîƥĚ ƥū ǩǪȦǯǪɼ Ŀƙ ČūŠƙĚƐƭĚŠƥ ƥū ČĺîŠijĚƙ ŞîēĚ ĿŠ ƥĺĚ GĿŠîŠČĚ

Act, 2018.

d) Current tax assets

(

`

cr)

Particulars

As at

March 31, 2019

As at

March 31, 2018

Opening balance

0.67

-

Add: Taxes paid in advance, net of provision during the year

3.07

0.67

Closing balance

3.74

0.67

e) Current tax liabilities

(

`

cr)

Particulars

As at

March 31, 2019

As at

March 31, 2018

Opening balance

8.01

1.99

Add: Current tax payable for the year

236.75

102.21

Less: Taxes paid

ȳǨǪǪȦǫǮȴ

(96.19)

Closing balance

0.18

8.01

Corporate Overview 01-22

Statutory Reports 23-105

Financial Statements 107-250

156

Atul Ltd | Annual Report 2018-19