Note 28.5 Current and deferred tax (continued)

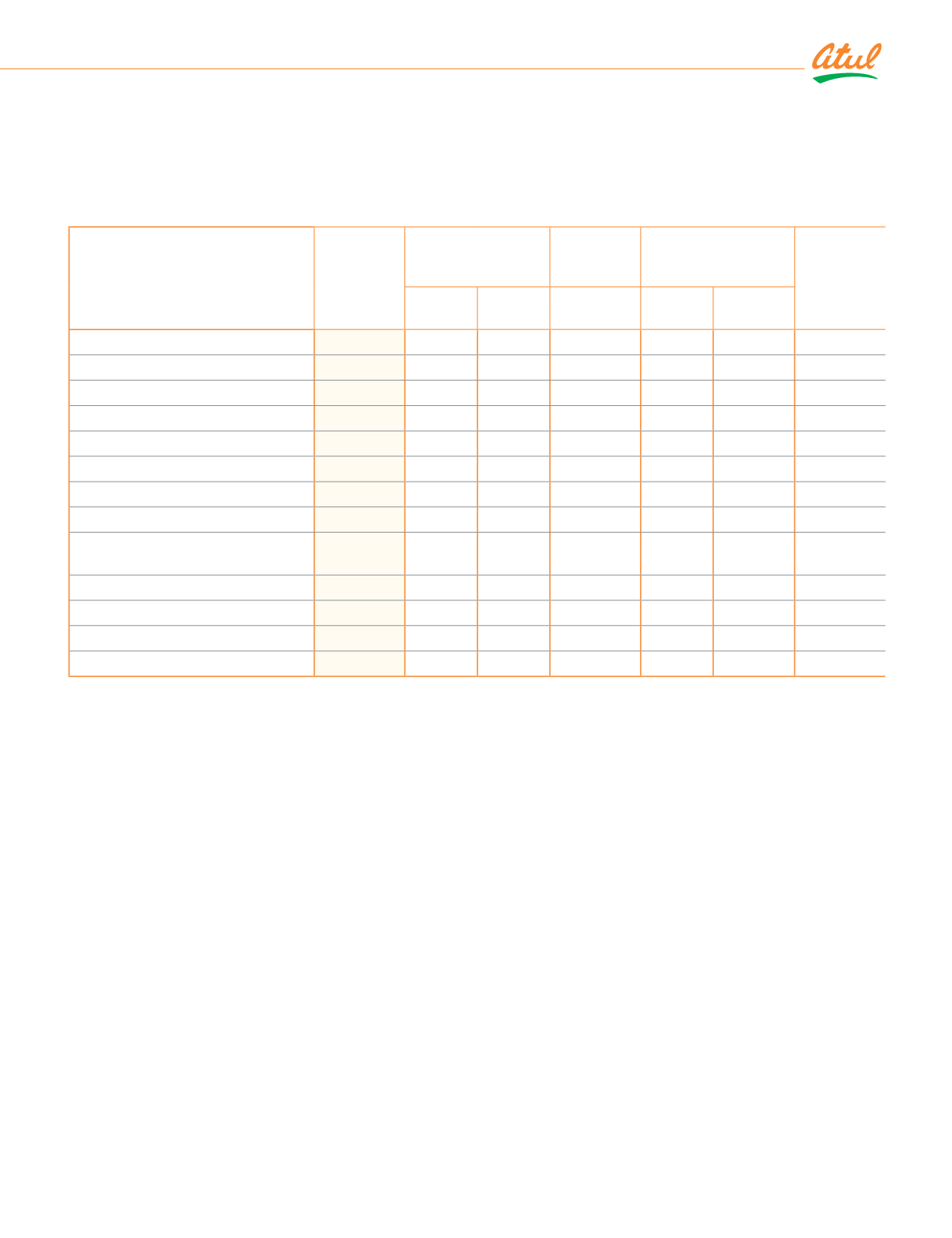

f) Deferred tax liabilities (net)

The balance comprises temporary differences attributable to the below items and corresponding movement in deferred

tax liabilities | (assets):

(

`

cr)

Particulars

As at

March 31,

2019

(Charged) |

Credited to

As at

March 31,

2018

(Charged) |

Credited to

As at

March 31,

2017

ƎƑūǛƥ ūƑ

loss

OCI |

equity

ƎƑūǛƥ ūƑ

loss

OCI |

equity

Property, plant and equipment

137.58

(2.75)

-

ǧǪǦȦǩǩ

1.59

-

ǧǩǮȦǭǪ

ÀŠƑĚîŕĿƙĚē ijîĿŠ ūŠ Şƭƥƭîŕ ljƭŠē

0.32

0.32

-

-

-

-

-

Fair value equity investments (net)

11.00

-

11.00

-

-

-

-

Total deferred tax liabilities

148.90

(2.43)

11.00

140.33

1.59

-

138.74

Provision for leave encashment

(8.83)

(0.25)

-

(8.58)

ǦȦǪǬ

-

ȳǯȦǦǪȴ

Provision for doubtful debts

(2.66)

(1.75)

-

(0.91)

0.19

-

(1.10)

Regulatory and other charges

(8.79)

(8.79)

-

-

-

-

-

Investment properties

ȳǬȦǪǮȴ

(0.27)

-

(6.21)

(2.26)

-

(3.95)

ÀŠƑĚîŕĿƙĚē q¹q ŕūƙƙĚƙ ūŠ

derivatives

-

-

-

-

1.75

-

(1.75)

îƙĺ ǜūDž ĺĚēijĚƙ

ǦȦǪǩ

-

ǦȦǪǧ

0.02

-

0.27

(0.25)

MAT credit entitlement

-

-

-

-

22.90

-

(22.90)

Total deferred tax assets

(26.33) (11.06)

0.41

(15.68)

23.04

0.27

(38.99)

Net deferred tax liabilities | (assets)

122.57 (13.49)

11.41

124.65

24.63

0.27

99.75

sūƥĚ ǨǮȦǬ /ŞƎŕūNjĚĚ ċĚŠĚǛƥ ūċŕĿijîƥĿūŠƙ

Funded schemes

îȴ 'ĚǛŠĚē ċĚŠĚǛƥ ƎŕîŠƙȠ

Gratuity

The Company operates a gratuity plan through the ‘Atul Ltd Employees Gratuity Fund’. Every employee is entitled to a

ċĚŠĚǛƥ ĚƐƭĿDŽîŕĚŠƥ ƥū ǧǫ ēîNjƙ ƙîŕîƑNj ŕîƙƥ ēƑîDžŠ ljūƑ ĚîČĺ ČūŞƎŕĚƥĚē NjĚîƑ ūlj ƙĚƑDŽĿČĚ ĿŠ ŕĿŠĚ DžĿƥĺ ƥĺĚ ¡îNjŞĚŠƥ ūlj HƑîƥƭĿƥNj

Čƥȡ ǧǯǭǨ ūƑ ūŞƎîŠNj ƙČĺĚŞĚȡ DžĺĿČĺĚDŽĚƑ Ŀƙ ċĚŠĚǛČĿîŕȦ ¹ĺĚ ƙîŞĚ Ŀƙ ƎîNjîċŕĚ îƥ ƥĺĚ ƥĿŞĚ ūlj ƙĚƎîƑîƥĿūŠ ljƑūŞ ƥĺĚ ūŞƎîŠNj

ūƑ ƑĚƥĿƑĚŞĚŠƥȡ DžĺĿČĺĚDŽĚƑ Ŀƙ ĚîƑŕĿĚƑȦ ¹ĺĚ ċĚŠĚǛƥƙ DŽĚƙƥ îljƥĚƑ ǛDŽĚ NjĚîƑƙ ūlj ČūŠƥĿŠƭūƭƙ ƙĚƑDŽĿČĚȦ

157

Standalone

|

Notes to the Financial Statements