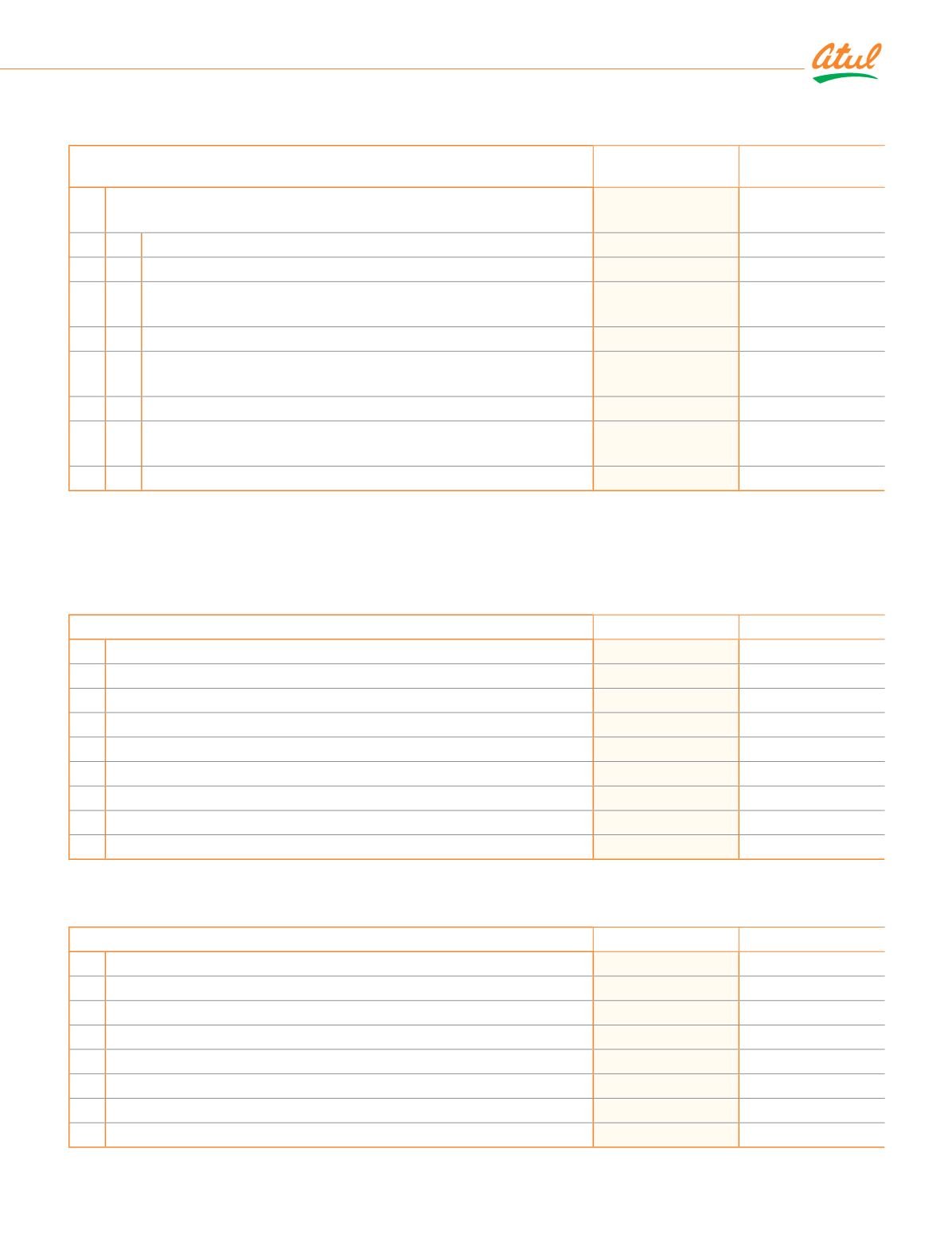

Note 29.5 Current and Deferred tax

¹ĺĚ ŞîŏūƑ ČūŞƎūŠĚŠƥƙ ūlj ĿŠČūŞĚ ƥîNJ ĚNJƎĚŠƙĚ ljūƑ ƥĺĚ NjĚîƑƙ ĚŠēĚē qîƑČĺ ǩǧȡ ǨǦǧǯ îŠē qîƑČĺ ǩǧȡ ǨǦǧǮ îƑĚȠ

îȴ TŠČūŞĚ ƥîNJ ĚNJƎĚŠƙĚ ƑĚČūijŠĿƙĚē ĿŠ ƥĺĚ ūŠƙūŕĿēîƥĚē ¬ƥîƥĚŞĚŠƥ ūlj ¡ƑūǛƥ îŠē gūƙƙȠ

(

`

cr)

Particulars

2018-19

2017-18

i)

Current tax

ƭƑƑĚŠƥ ƥîNJ ūŠ ƎƑūǛƥ ljūƑ ƥĺĚ NjĚîƑ

ǨǪǨȦǭǩ

ǧǦǯȦǦǪ

ēŏƭƙƥŞĚŠƥƙ ljūƑ ČƭƑƑĚŠƥ ƥîNJ ūlj ƎƑĿūƑ ƎĚƑĿūēƙ

0.89

(0.88)

¹ūƥîŕ ČƭƑƑĚŠƥ ƥîNJ ĚNJƎĚŠƙĚ

243.62

108.16

ii) Deferred tax

ȳ'ĚČƑĚîƙĚȴ ʈ TŠČƑĚîƙĚ ĿŠ ēĚljĚƑƑĚē ƥîNJ ŕĿîċĿŕĿƥĿĚƙ

ǨǪȦǦǧ

2.15

'ĚČƑĚîƙĚ ʈ ȳTŠČƑĚîƙĚȴ ĿŠ ēĚljĚƑƑĚē ƥîNJ îƙƙĚƥƙ

(23.31)

20.66

¹ūƥîŕ ēĚljĚƑƑĚē ƥîNJ ĚNJƎĚŠƙĚ ʈ ȳċĚŠĚǛƥȴ

0.70

22.81

Income tax expense

244.32

130.97

ċȴ TŠČūŞĚ ƥîNJ ĚNJƎĚŠƙĚ ƑĚČūijŠĿƙĚē ĿŠ ¬ƥîƥĚŞĚŠƥ ūlj ūƥĺĚƑ ČūŞƎƑĚĺĚŠƙĿDŽĚ ĿŠČūŞĚȠ

(

`

cr)

Particulars

2018-19

2017-18

i)

Current tax

¤ĚŞĚîƙƭƑĚŞĚŠƥ ijîĿŠ ʈ ȳŕūƙƙȴ ūŠ ēĚǛŠĚē ċĚŠĚǛƥ ƎŕîŠƙ

(0.08)

0.95

¹ūƥîŕ ČƭƑƑĚŠƥ ƥîNJ ĚNJƎĚŠƙĚ

(0.08)

0.95

ii) Deferred tax

Fair value equity investment

11.00

-

/ljljĚČƥĿDŽĚ ƎūƑƥĿūŠ ūlj ijîĿŠ ʈ ȳŕūƙƙȴ ūŠ Čîƙĺ ǜūDž ĺĚēijĚƙ

ǦȦǪǩ

0.02

¹ūƥîŕ ēĚljĚƑƑĚē ƥîNJ ĚNJƎĚŠƙĚ ʈ ȳċĚŠĚǛƥȴ

11.43

0.02

Income tax expense

11.35

0.97

Note 29.4 Related party disclosures (continued)

(

`

cr)

Note 29.4 (H) Outstanding balances at the year end

As at

March 31, 2019

As at

March 31, 2018

e) With entities over which Key Management Personnel or their close

ljîŞĿŕNj ŞĚŞċĚƑƙ ĺîDŽĚ ƙĿijŠĿǛČîŠƥ ĿŠǜƭĚŠČĚ

1 Receivables

0.03

0.07

ƥƭŕ eĚŕîDŽîŠĿ qîŠēîŕ ȳ ƭƑƑĚŠƥ NjĚîƑȠ ɞ ǪǫȡǮǦǪȴ

0.05

ƥƭŕ ¤ƭƑîŕ 'ĚDŽĚŕūƎŞĚŠƥ GƭŠē ȳ ƭƑƑĚŠƥ NjĚîƑȠ ɞ ǪǧȡǨǭǬ îŠē ¡ƑĚDŽĿūƭƙ

year:

`

ǨǫȡǫǬǪȴ

Atul Vidyalaya

0.03

0.02

ÀƑŞĿ ¬ƥƑĚĚ ¬îŠƙƥĺî ȳ ƭƑƑĚŠƥ NjĚîƑȠ

`

ǨǧȡǯǧǪ îŠē ¡ƑĚDŽĿūƭƙ NjĚîƑȠ

`

7,199)

2 Payables

0.02

-

Atul Rural Development Fund (Current year:

`

15,000 and Previous

year:

`

12,500)

Atul Vidyalaya

0.02

-

Consolidated

|

Notes to the Financial Statements

221