sūƥĚ ǨǯȦǬ /ŞƎŕūNjĚĚ ċĚŠĚǛƥ ūċŕĿijîƥĿūŠƙ ȳČūŠƥĿŠƭĚēȴ

Risk exposure

¹ĺƑūƭijĺ Ŀƥƙ ēĚǛŠĚē ċĚŠĚǛƥ ƎŕîŠƙȡ ƥĺĚ HƑūƭƎ Ŀƙ ĚNJƎūƙĚē ƥū î ŠƭŞċĚƑ ūlj ƑĿƙŒƙȡ ƥĺĚ Şūƙƥ ƙĿijŠĿǛČîŠƥ ūlj DžĺĿČĺ îƑĚ ēĚƥîĿŕĚē ċĚŕūDžȠ

i)

Asset volatility

The plan liabilities are calculated using a discount rate set with reference to bond yields; if plan assets underperform this

NjĿĚŕēȡ ƥĺĿƙ DžĿŕŕ ČƑĚîƥĚ î ēĚǛČĿƥȦ qūƙƥ ūlj ƥĺĚ ƎŕîŠ îƙƙĚƥ ĿŠDŽĚƙƥŞĚŠƥƙ îƑĚ ĿŠ ǛNJĚē ĿŠČūŞĚ ƙĚČƭƑĿƥĿĚƙ DžĿƥĺ ĺĿijĺ ijƑîēĚƙ îŠē

ĿŠ ijūDŽĚƑŠŞĚŠƥ ƙĚČƭƑĿƥĿĚƙȦ ¹ĺĚƙĚ îƑĚ ƙƭċŏĚČƥ ƥū ĿŠƥĚƑĚƙƥ ƑîƥĚ ƑĿƙŒȦ ¹ĺĚ HƑūƭƎ ĺîƙ î ƑĿƙŒ ŞîŠîijĚŞĚŠƥ ƙƥƑîƥĚijNj DžĺĚƑĚ ƥĺĚ

îijijƑĚijîƥĚ îŞūƭŠƥ ūlj ƑĿƙŒ ĚNJƎūƙƭƑĚ ūŠ î ƎūƑƥljūŕĿū ŕĚDŽĚŕ Ŀƙ ŞîĿŠƥîĿŠĚē îƥ î ǛNJĚē ƑîŠijĚȦ ŠNj ēĚDŽĿîƥĿūŠƙ ljƑūŞ ƥĺĚ ƑîŠijĚ îƑĚ

ČūƑƑĚČƥĚē ċNj ƑĚċîŕîŠČĿŠij ƥĺĚ ƎūƑƥljūŕĿūȦ ¹ĺĚ HƑūƭƎ ĿŠƥĚŠēƙ ƥū ŞîĿŠƥîĿŠ ƥĺĚ îċūDŽĚ ĿŠDŽĚƙƥŞĚŠƥ ŞĿNJ ĿŠ ƥĺĚ ČūŠƥĿŠƭĿŠij NjĚîƑƙȦ

ii) Changes in bond yields

A decrease in bond yields will increase plan liabilities, although this will be partially offset by an increase in the value of

other bond holdings.

¹ĺĚ HƑūƭƎ îČƥĿDŽĚŕNj ŞūŠĿƥūƑƙ ĺūDž ƥĺĚ ēƭƑîƥĿūŠ îŠē ƥĺĚ ĚNJƎĚČƥĚē NjĿĚŕē ūlj ƥĺĚ ĿŠDŽĚƙƥŞĚŠƥƙ îƑĚ ŞîƥČĺĿŠij ƥĺĚ ĚNJƎĚČƥĚē Čîƙĺ

ūƭƥǜūDžƙ îƑĿƙĿŠij ljƑūŞ ƥĺĚ ĚŞƎŕūNjĚĚ ċĚŠĚǛƥ ūċŕĿijîƥĿūŠƙȦ ¹ĺĚ HƑūƭƎ ĺîƙ Šūƥ ČĺîŠijĚē ƥĺĚ ƎƑūČĚƙƙĚƙ ƭƙĚē ƥū ŞîŠîijĚ Ŀƥƙ

ƑĿƙŒƙ ljƑūŞ ƎƑĚDŽĿūƭƙ ƎĚƑĿūēƙȦ TŠDŽĚƙƥŞĚŠƥƙ îƑĚ DžĚŕŕ ēĿDŽĚƑƙĿǛĚēȡ ƙƭČĺ ƥĺîƥ ƥĺĚ ljîĿŕƭƑĚ ūlj îŠNj ƙĿŠijŕĚ ĿŠDŽĚƙƥŞĚŠƥ Džūƭŕē Šūƥ ĺîDŽĚ

a material impact on the overall level of assets.

A large portion of assets consists insurance funds, although the Group also invests in corporate bonds and special deposit

ƙČĺĚŞĚȦ ¹ĺĚ ƎŕîŠ îƙƙĚƥ ŞĿNJ Ŀƙ ĿŠ ČūŞƎŕĿîŠČĚ DžĿƥĺ ƥĺĚ ƑĚƐƭĿƑĚŞĚŠƥƙ ūlj ƥĺĚ ƑĚƙƎĚČƥĿDŽĚ ŕūČîŕ ƑĚijƭŕîƥĿūŠƙȦ

/NJƎĚČƥĚē ČūŠƥƑĿċƭƥĿūŠƙ ƥū ƎūƙƥȹĚŞƎŕūNjŞĚŠƥ ċĚŠĚǛƥ ƎŕîŠƙ ljūƑ ƥĺĚ NjĚîƑ ĚŠēĿŠij qîƑČĺ ǩǧȡ ǨǦǨǦ îƑĚ

`

2.75 cr.

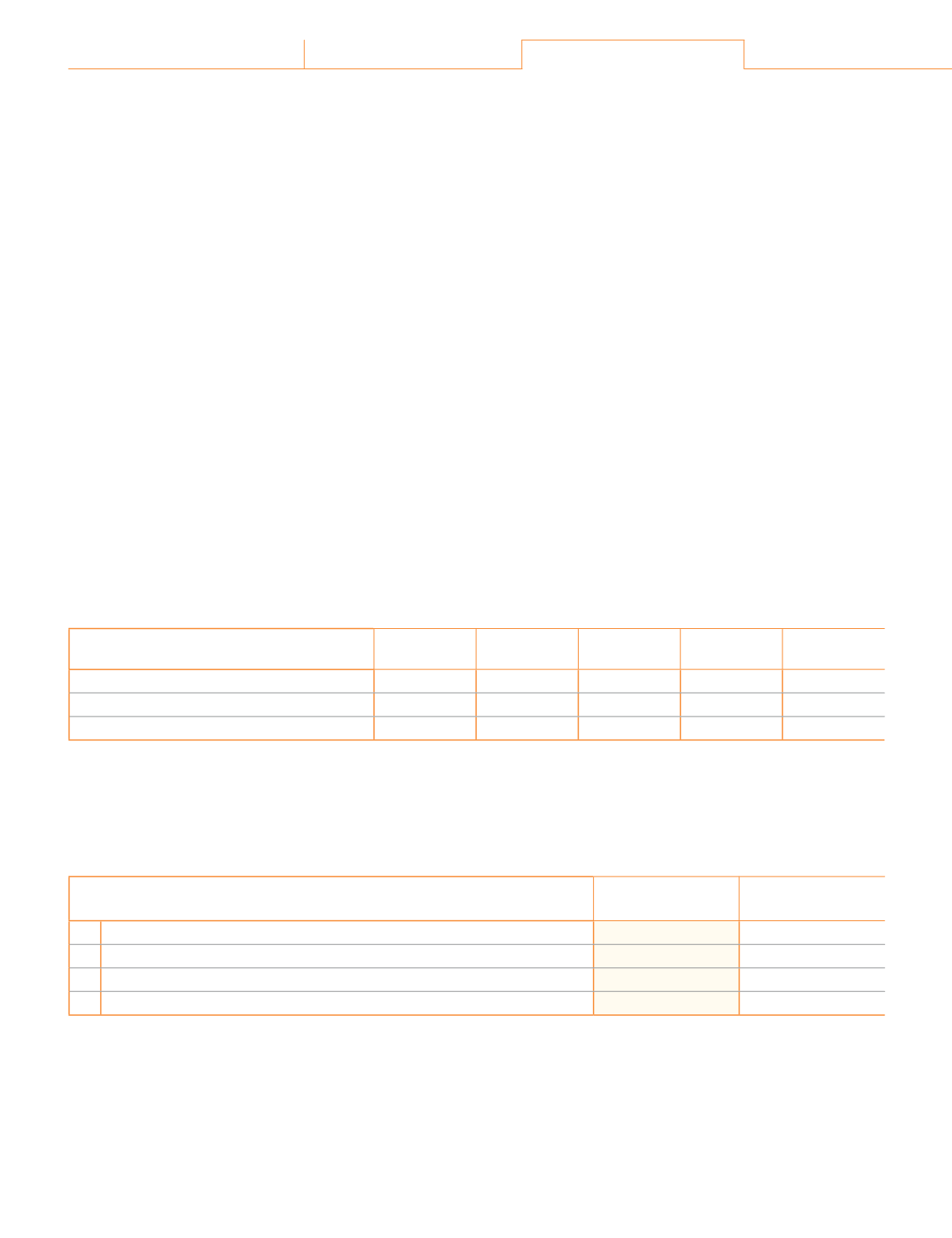

¹ĺĚ DžĚĿijĺƥĚē îDŽĚƑîijĚ ēƭƑîƥĿūŠ ūlj ƥĺĚ ēĚǛŠĚē ċĚŠĚǛƥ ūċŕĿijîƥĿūŠ Ŀƙ Ǭ NjĚîƑƙȦ ¹ĺĚ ĚNJƎĚČƥĚē ŞîƥƭƑĿƥNj îŠîŕNjƙĿƙ ūlj ijƑîƥƭĿƥNj Ŀƙ

as follows:

(

`

cr)

Particulars

Less than a

year

Between

1 - 2 years

Between

2 - 5 years

Over 5 years

Total

/NJƎĚČƥĚē ēĚǛŠĚē ċĚŠĚǛƥ ūċŕĿijîƥĿūŠ ȳijƑîƥƭĿƥNjȴ

As at March 31, 2019

12.73

6.57

18.38

27.12

ǬǪȦǮǦ

As at March 31, 2018

9.8

6.33

19.83

ǪǬȦǧ

82.06

¡ƑūDŽĿēĚŠƥ ljƭŠēȠ

In case of certain employees, the provident fund contribution is made to a trust administered by the Group. The actuary has

provided a valuation of provident fund liability based on the assumptions listed below and determined that there is no shortfall

as at March 31, 2019.

(

`

cr)

Expenses recognised for the year ended March 31, 2019 (included in Note

26)

As at

March 31, 2019

As at

March 31, 2018

i)

'ĚǛŠĚē ċĚŠĚǛƥ ūċŕĿijîƥĿūŠ

10.29

ǯȦǪǮ

ii) Fund

10.25

9.81

iii) Net asset | (liability)

ȳǦȦǦǪȴ

0.33

iv)

ĺîƑijĚ ƥū ƥĺĚ ūŠƙūŕĿēîƥĚē ¬ƥîƥĚŞĚŠƥ ūlj ¡ƑūǛƥ îŠē gūƙƙ ēƭƑĿŠij ƥĺĚ NjĚîƑ

0.28

0.20

226

Atul Ltd | Annual Report 2018-19

Corporate Overview 01-22

Statutory Reports 23-105

Financial Statements 107-250