Note 29.5 Current and Deferred tax (continued)

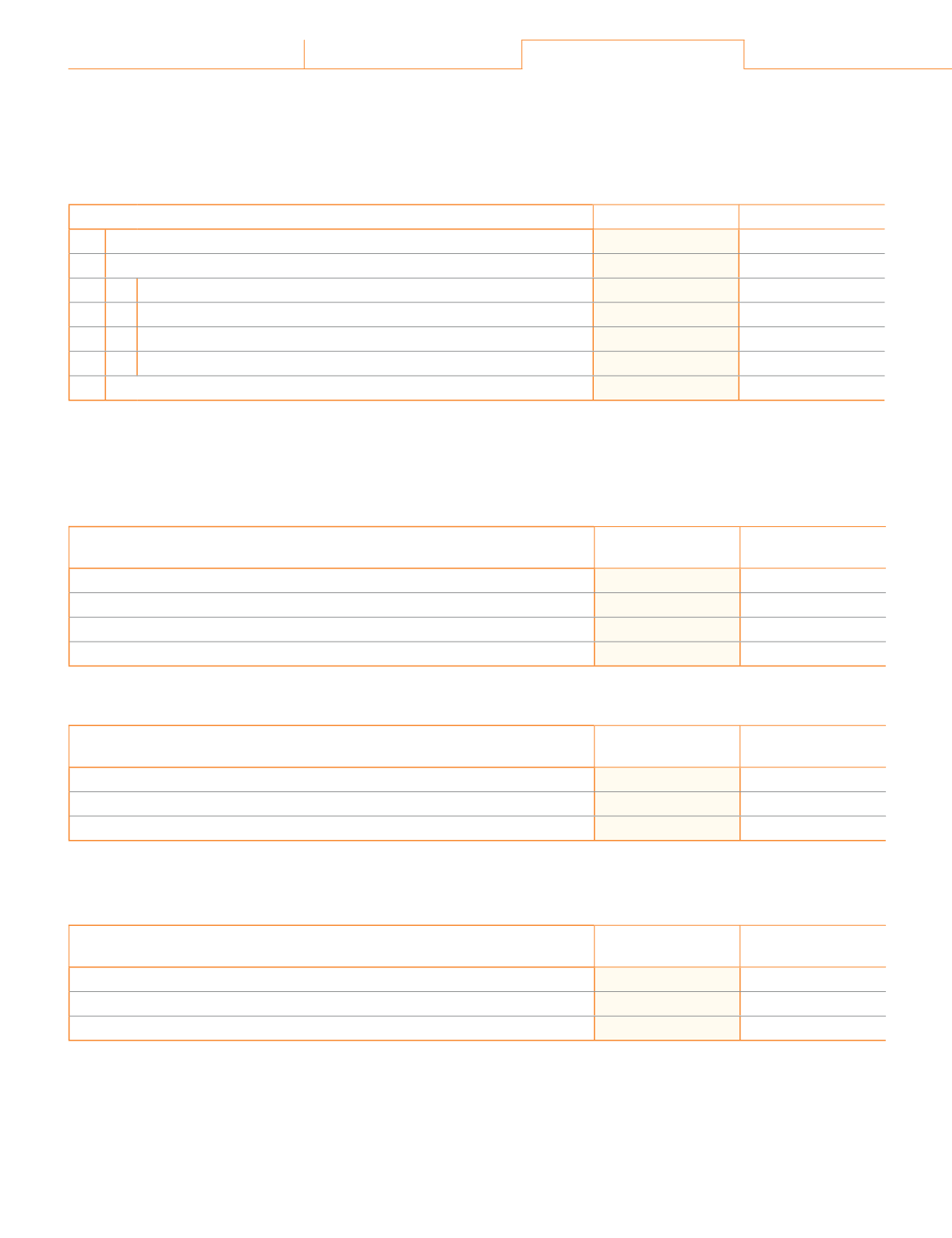

c) The reconciliation between the statutory income tax rate applicable to the Group and the effective income tax rate

ūlj ƥĺĚ HƑūƭƎ Ŀƙ îƙ ljūŕŕūDžƙȠ

(

`

cr)

Particulars

2018-19

2017-18

a)

¬ƥîƥƭƥūƑNj ĿŠČūŞĚ ƥîNJ ƑîƥĚ

ǩǪȦǯǪɼ

ǩǪȦǬǧɼ

b)

Differences due to:

i)

/NJƎĚŠƙĚƙ Šūƥ ēĚēƭČƥĿċŕĚ ljūƑ ƥîNJ ƎƭƑƎūƙĚƙ

ǦȦǪǯɼ

1.05%

ii)

TŠČūŞĚ ĚNJĚŞƎƥ ljƑūŞ ĿŠČūŞĚ ƥîNJ

ȳǦȦǪǦɼȴ

(1.63%)

iii)

TŠČūŞĚ ƥîNJ ĿŠČĚŠƥĿDŽĚƙ

(1.15%)

(0.50%)

iv) Others

2.03%

(1.69%)

Effective income tax rate

35.91%

31.84%

¹ĺĚ îƎƎŕĿČîċŕĚ ƙƥîƥƭƥūƑNj ĿŠČūŞĚ ƥîNJ ƑîƥĚ ljūƑ ƥĺĚ NjĚîƑƙ ĚŠēĚē qîƑČĺ ǩǧȡ ǨǦǧǯ îŠē qîƑČĺ ǩǧȡ ǨǦǧǮ Ŀƙ ǩǪȦǯǪɼ îŠē ǩǪȦǬǧɼȡ

ƑĚƙƎĚČƥĿDŽĚŕNjȦ ¹ĺĚ ĿŠČƑĚîƙĚ ĿŠ ƥĺĚ ČūƑƎūƑîƥĚ ƙƥîƥƭƥūƑNj ĿŠČūŞĚ ƥîNJ ƑîƥĚ ƥū ǩǪȦǯǪɼ Ŀƙ ČūŠƙĚƐƭĚŠƥ ƥū ČĺîŠijĚƙ ŞîēĚ ĿŠ ƥĺĚ GĿŠîŠČĚ

Act, 2018.

d) Current tax liabilities (net)

(

`

cr)

Particulars

As at

March 31, 2019

As at

March 31, 2018

Opening balance

8.13

3.39

ēēȠ ƭƑƑĚŠƥ ƥîNJ ƎîNjîċŕĚ ljūƑ ƥĺĚ NjĚîƑ

ǨǪǩȦǬǨ

108.16

gĚƙƙȠ ¹îNJ ƎîĿē

(251.08)

ȳǧǦǩȦǪǨȴ

Closing balance

0.67

8.13

e) Current tax assets (net)

(

`

cr)

Particulars

As at

March 31, 2019

As at

March 31, 2018

Opening balance

2.58

1.21

ēēȠ ¹îNJĚƙ ƎîĿē ĿŠ îēDŽîŠČĚȡ ŠĚƥ ūlj ƎƑūDŽĿƙĿūŠƙ ēƭƑĿŠij ƥĺĚ NjĚîƑ

ǫȦǮǪ

1.37

Closing balance

8.42

2.58

f) Deferred tax liabilities | (assets)

¹ĺĚ ljūŕŕūDžĿŠij Ŀƙ ƥĺĚ îŠîŕNjƙĿƙ ūlj ēĚljĚƑƑĚē ƥîNJ ŕĿîċĿŕĿƥĿĚƙ ʈ ȳîƙƙĚƥƙȴ ċîŕîŠČĚƙ ƎƑĚƙĚŠƥĚē ĿŠ ƥĺĚ ūŠƙūŕĿēîƥĚē îŕîŠČĚ ¬ĺĚĚƥȠ

(

`

cr)

Particulars

As at

March 31, 2019

As at

March 31, 2018

'ĚljĚƑƑĚē ƥîNJ ŕĿîċĿŕĿƥĿĚƙ

ǧǩǯȦǪǮ

129.55

'ĚljĚƑƑĚē ƥîNJ îƙƙĚƥƙ

(0.52)

(5.01)

138.96

124.54

222

Atul Ltd | Annual Report 2018-19

Corporate Overview 01-22

Statutory Reports 23-105

Financial Statements 107-250