sūƥĚ ǨǯȦǬ /ŞƎŕūNjĚĚ ċĚŠĚǛƥ ūċŕĿijîƥĿūŠƙ ȳČūŠƥĿŠƭĚēȴ

¬ĿijŠĿǛČîŠƥ ĚƙƥĿŞîƥĚƙȠ ČƥƭîƑĿîŕ îƙƙƭŞƎƥĿūŠƙ îŠē ƙĚŠƙĿƥĿDŽĿƥNj

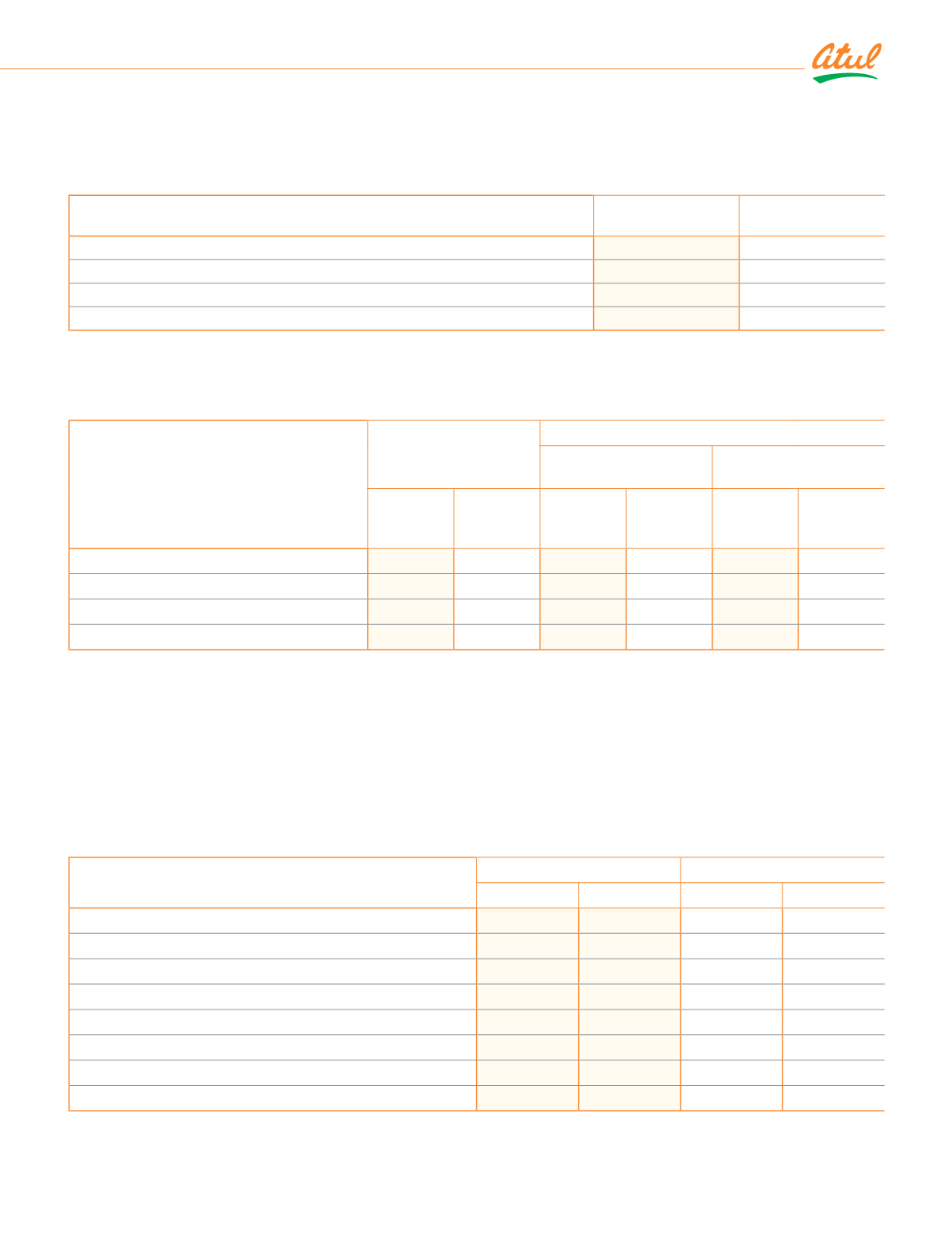

¹ĺĚ ƙĿijŠĿǛČîŠƥ îČƥƭîƑĿîŕ îƙƙƭŞƎƥĿūŠƙ DžĚƑĚ îƙ ljūŕŕūDžƙȠ

(

`

cr)

Particulars

As at

March 31, 2019

As at

March 31, 2018

Discount rate

7.22%

7.68%

Attrition rate

11.87%

9.70%

Rate of return on plan assets

7.22%

7.68%

Salary escalation rate

ǮȦǦǪɼ

8.27% and 6.00%

Sensitivity analysis

¹ĺĚ ƙĚŠƙĿƥĿDŽĿƥNj ūlj ƥĺĚ ēĚǛŠĚē ċĚŠĚǛƥ ūċŕĿijîƥĿūŠ ƥū ČĺîŠijĚƙ ĿŠ ƥĺĚ DžĚĿijĺƥĚē ƎƑĿŠČĿƎîŕ îƙƙƭŞƎƥĿūŠƙ ĿƙȠ

(

`

cr)

Particulars

Change in assumptions

TŞƎîČƥ ūŠ ēĚǛŠĚē ċĚŠĚǛƥ ūċŕĿijîƥĿūŠ

Increase in

assumptions

Decrease in

assumptions

As at

March 31,

2019

As at

March 31,

2018

As at

March 31,

2019

As at

March 31,

2018

As at

March 31,

2019

As at

March 31,

2018

Discount rate

1.00% 1.00%

ȳǩȦǧǪɼȴ

ȳǩȦǪǬɼȴ

ǩȦǪǨɼ

3.78%

Attrition rate

1.00% 1.00% (0.22%)

(0.11%)

0.23% 0.12%

Rate of return on plan assets

1.00% 1.00%

ȳǩȦǧǪɼȴ

ȳǩȦǪǬɼȴ

ǩȦǪǨɼ

3.78%

Salary escalation rate

1.00% 1.00% 3.36%

ǩȦǭǪɼ

(3.15%)

ȳǩȦǪǯɼȴ

The above sensitivity analyses are based on a change in an assumption while holding all other assumptions constant. In

practice, this is unlikely to occur and changes in some of the assumptions may be correlated. When calculating the sensitivity

ūlj ƥĺĚ ēĚǛŠĚē ċĚŠĚǛƥ ūċŕĿijîƥĿūŠ ƥū ƙĿijŠĿǛČîŠƥ îČƥƭîƑĿîŕ îƙƙƭŞƎƥĿūŠƙȡ ƥĺĚ ƙîŞĚ ŞĚƥĺūē ȳƎƑĚƙĚŠƥ DŽîŕƭĚ ūlj ƥĺĚ ēĚǛŠĚē ċĚŠĚǛƥ

ūċŕĿijîƥĿūŠ ČîŕČƭŕîƥĚē DžĿƥĺ ƥĺĚ ƎƑūŏĚČƥĚē ƭŠĿƥ ČƑĚēĿƥ ŞĚƥĺūē îƥ ƥĺĚ ĚŠē ūlj ƥĺĚ ƑĚƎūƑƥĿŠij ƎĚƑĿūēȴ ĺîƙ ċĚĚŠ îƎƎŕĿĚē DžĺĿŕĚ ČîŕČƭŕîƥĿŠij

ƥĺĚ ēĚǛŠĚē ċĚŠĚǛƥ ŕĿîċĿŕĿƥNj ƑĚČūijŠĿƙĚē ĿŠ ƥĺĚ îŕîŠČĚ ¬ĺĚĚƥȦ

The methods and types of assumptions used in preparing the sensitivity analysis did not change as compared to the prior year.

qîŏūƑ ČîƥĚijūƑĿĚƙ ūlj ƎŕîŠ îƙƙĚƥƙ îƑĚ îƙ ljūŕŕūDžƙȠ

(

`

cr)

Particulars

As at March 31, 2019

As at March 31, 2018

Unquoted

in % Unquoted

in %

Government of India assets

1.18

ǨȦǪǪɼ

1.18

ǨȦǫǪɼ

Debt instruments

Corporate bonds

1.05

2.18%

0.98

2.11%

Investment funds

Insurance fund

ǪǩȦǧǯ

ǮǯȦǪǪɼ ǪǪȦǧǫ

ǯǪȦǯǭɼ

Others

2.70

5.60%

0.02

ǦȦǦǪɼ

Special deposit scheme

0.16

0.33%

0.16

ǦȦǩǪɼ

48.28

100.00% 46.49

100.00%

Consolidated

|

Notes to the Financial Statements

225