Atul Ltd | Annual Report 2017-18

(

`

cr)

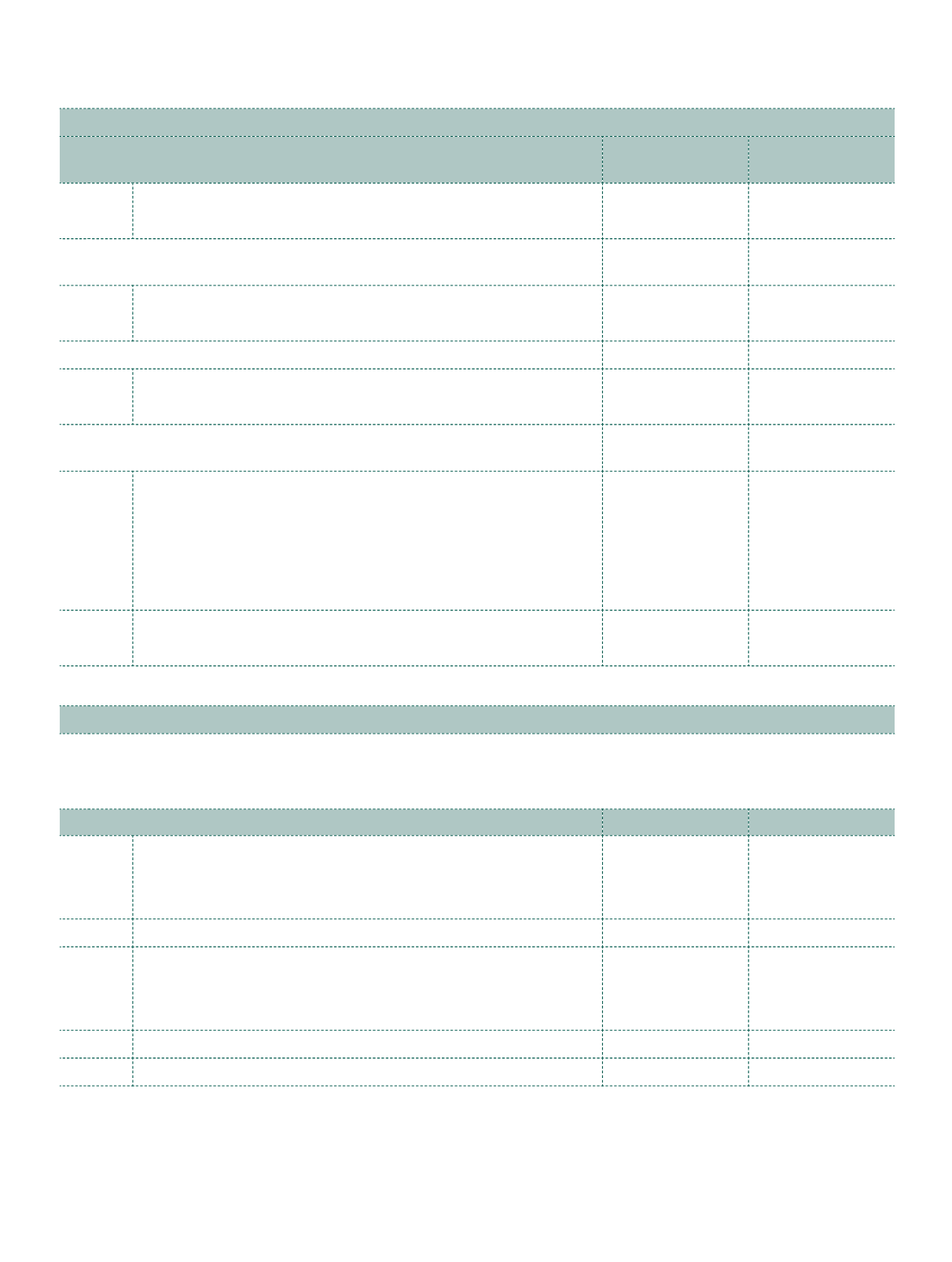

Note 29.4 (G) Outstanding balances at the year end

a) With entity over which control exercised by Key Management

Personnel

As at

March 31, 2018

As at

March 31, 2017

1 Loan Payables

6.50

–

Aagam Holdings Pvt Ltd

6.50

–

b) With entity over which control exercised

by Joint Venturer

1 Payables

0.75

1.34

Rudolf GmbH

0.75

1.34

c) With Key Management Personnel

1 Payables

0.01

0.01

Deposits of Directors

0.01

0.01

d) With entities over which Key Management Personnel or their close

family members have significant influence

1 Receivables

0.07

0.03

Atul Kelavani Mandal (Previous year:

`

35,655)

0.05

–

Atul Rural Development Fund (Current year:

`

25,564)

0.01

Atul Vidyalaya

0.02

0.02

Urmi Stree Sanstha (Current year:

`

7,199 and Previous year:

`

1,864)

2 Payables

0.03

Atul Rural Development Fund (Current year:

`

12,500)

0.03

Note 29.5 Current and Deferred tax

The major components of income tax expense for the years ended March 31, 2018 and March 31, 2017 are:

a) Income tax expense recognised in the Consolidated Statement of Profit or Loss:

(

`

cr)

Particulars

2017-18

2016-17

i)

Current tax

Current tax on profit for the year

109.04

89.22

Adjustments for current tax of prior periods

(0.88)

(2.11)

Total current tax expense

108.16

87.11

ii)

Deferred tax

(Decrease) | Increase in deferred tax liabilities

2.15

63.73

Decrease | (Increase) in deferred tax assets

20.66

(28.13)

Total deferred tax expense | (benefit)

22.81

35.60

Income tax expense

130.97

122.71

Notes

to the Consolidated Financial Statements