193

Note 29.6 Employee benefit obligations

(continued)

Risk exposure

Through its defined benefit plans, the Group is exposed to a number of risks, the most significant of which are detailed

below:

i)

Asset volatility

The plan liabilities are calculated using a discount rate set with reference to bond yields; if plan assets underperform

this yield, this will create a deficit. Most of the plan asset investments are in fixed income securities with high grades

and in Government securities. These are subject to interest rate risk. The Group has a Risk Management strategy

where the aggregate amount of risk exposure on a portfolio level is maintained at a fixed range. Any deviations

from the range are corrected by rebalancing the portfolio. The Group intends to maintain the above investment

mix in the continuing years.

ii)

Changes in bond yields

A decrease in bond yields will increase plan liabilities, although this will be partially offset by an increase in the value

of other bond holdings.

The Group actively monitors how the duration and the expected yield of the investments are matching the expected

cash outflows arising from the employee benefit obligations. The Group has not changed the processes used

to manage its risks from previous periods. Investments are well diversified, such that the failure of any single

investment will not have a material impact on the overall level of assets.

A large portion of assets consists of insurance funds, although the Group also invests in corporate bonds and special

deposit schemes. The plan asset mix is in compliance with the requirements of the respective local regulations.

Expected contributions to post-employment benefit plans for the year ending March 31, 2019 are

`

2.83 cr.

The weighted average duration of the defined benefit obligation is 6 years (2016-17: 5 years). The expected

maturity analysis of gratuity is as follows:

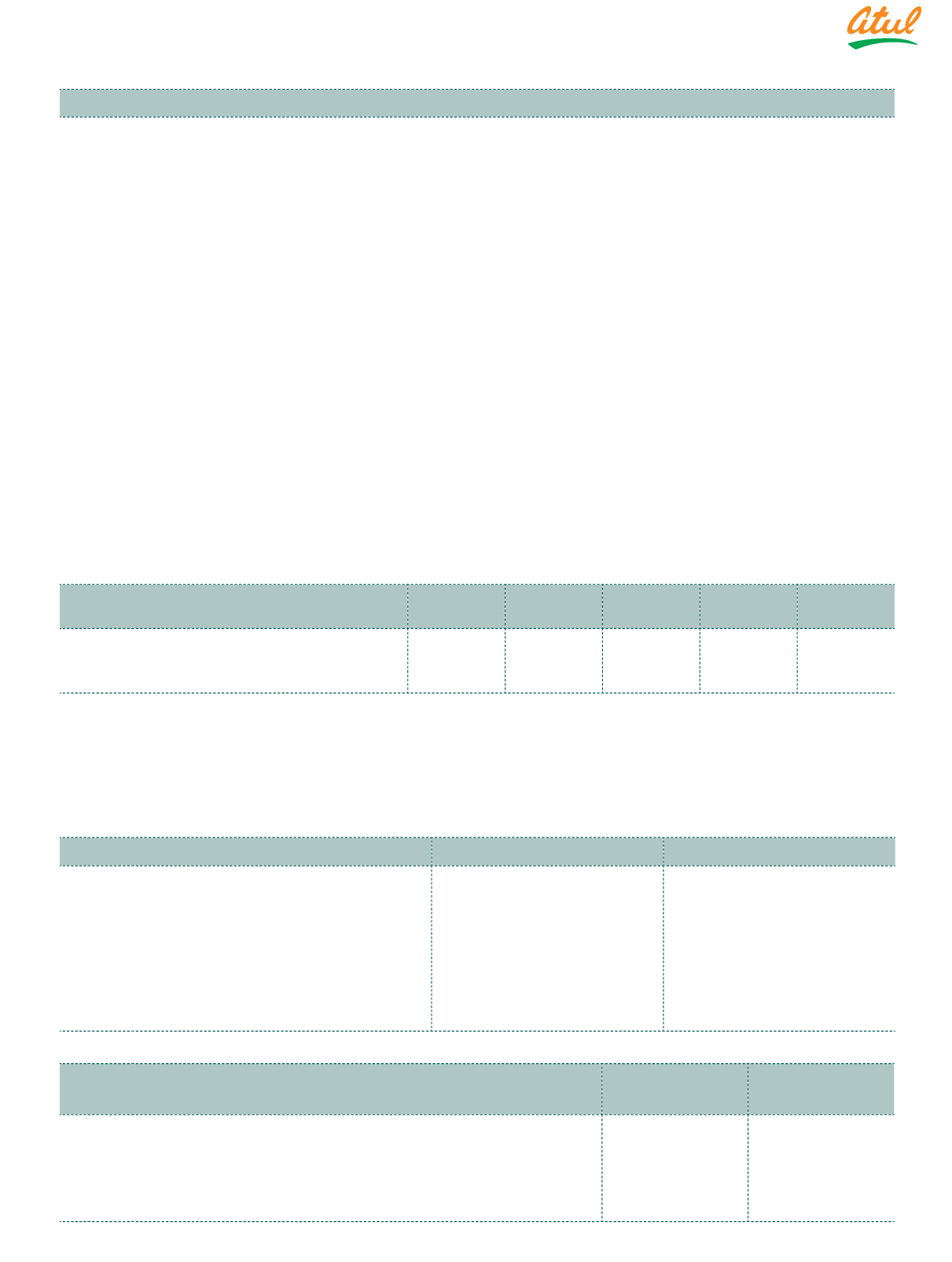

Particulars

Less than a

year

Between

1 - 2 year

Between

2 - 5 year

Over 5 year

Total

Defined benefit obligation (gratuity)

As at March 31, 2018

9.80

6.33

19.83

46.10

82.06

As at March 31, 2017

7.45

5.75

20.50

51.22

84.92

Provident Fund:

In case of certain employees, the Provident Fund contribution is made to a trust administered by the Group. The actuary

has provided a valuation of Provident Fund liability based on the assumptions listed below and determined that there is

no shortfall as at March 31, 2018.

The assumptions used in determining the present value of obligation of the interest rate guarantee under deterministic

approach are:

Particulars

2017-18

2016-17

i)

Mortality rate

Indian Assured Lives Mortality

(2006-08) Ultimate

Indian Assured Lives Mortality

(2006-08) Ultimate

ii)

Withdrawal rates

5.0% p.a. for all age groups

6% p.a. for all age groups

iii)

Rate of discount

7.68%

7.22%

iv)

Expected rate of interest

8.65%

8.65%

v)

Retirement age

60 years

60 years

vi)

Guaranteed rate of interest

8.65%

8.65%

(

`

cr)

Expenses recognised for the year ended March 31, 2018

(included in Note 26)

As at

March 31, 2018

As at

March 31, 2017

i)

Defined benefit obligation

9.48

9.14

ii)

Fund

9.81

9.16

iii)

Net asset | (liability)

0.33

0.03

iv)

Charge to the Consolidated Statement of Profit and Loss during

the year

0.20

0.20

Notes

to the Consolidated Financial Statements