Atul Ltd | Annual Report 2017-18

Note 29.6 Employee benefit obligations

(continued)

b) Defined contribution plans:

Provident and other funds:

Amount of

`

10.33 cr (March 31, 2017:

`

10.28 cr) is recognised as expense and included in Note 26 ‘Contribution to

Provident and other funds’.

Compensated absences:

Amount of

`

1.11 cr (March 31, 2017:

`

6.02 cr) is recognised as expense and included in Note 26 ‘Salaries, wages and

bonus’.

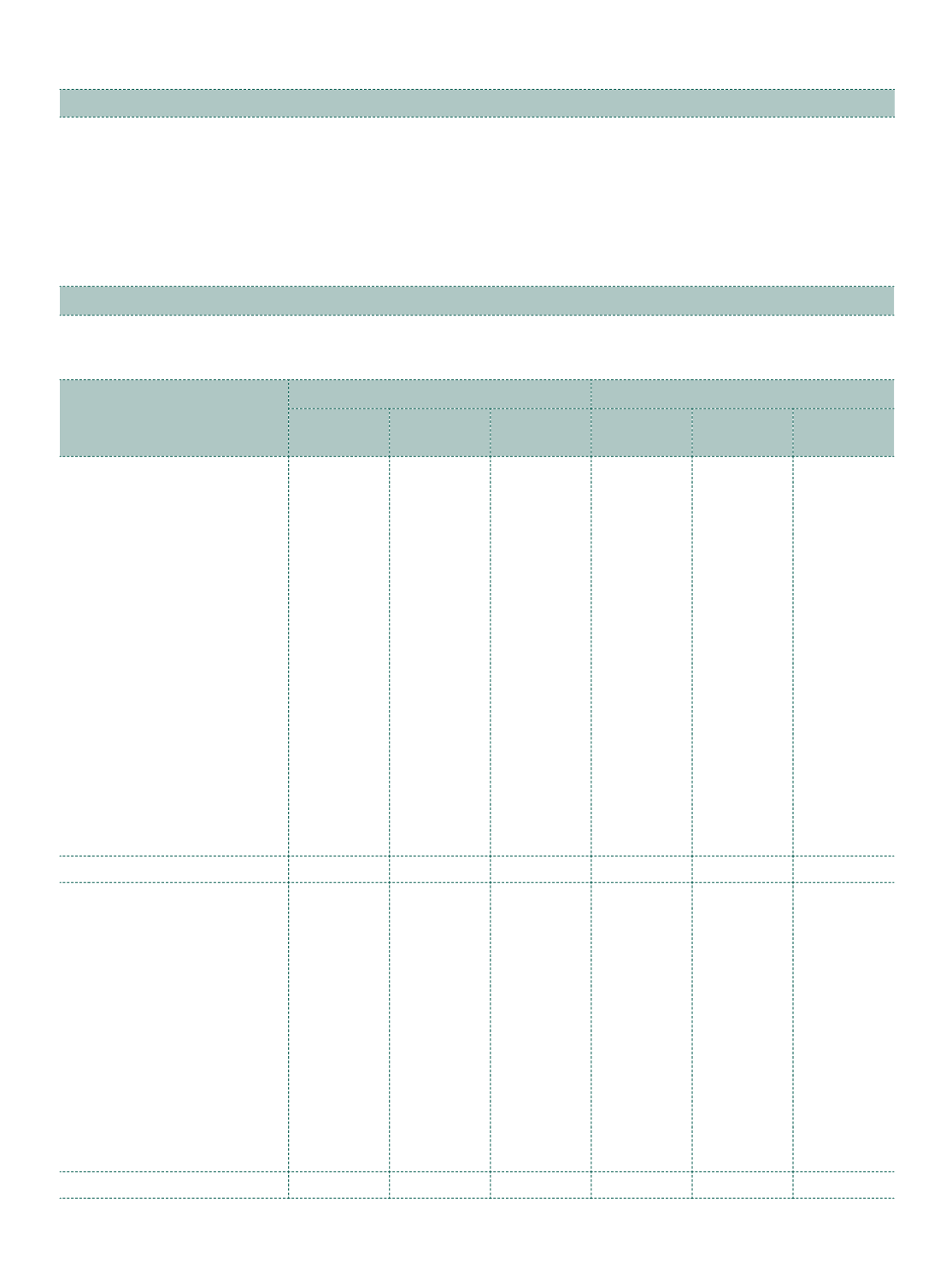

Note 29.7 Fair value measurements

Financial instruments by category

(

`

cr)

Particulars

As at March 31, 2018

As at March 31, 2017

FVPL

FVOCI

Amortised

cost

FVPL

FVOCI

Amortised

cost

Financial assets

Investments:

Equity instruments

–

453.30

–

–

415.91

–

Mutual funds

5.70

–

–

2.92

–

–

Government securities

–

–

0.01

–

–

0.01

NHAI bonds

–

–

0.10

–

–

0.10

Share application money

–

0.01

–

–

–

–

Trade receivables

–

–

723.40

–

–

518.96

Loans

–

–

0.20

–

–

–

Security deposits for utilities

and premises

–

–

1.48

–

–

1.59

Dividends receivable

–

–

3.51

–

–

9.40

Derivative financial assets

designated as hedges

–

0.07

–

–

1.70

–

Cash and bank balances

–

–

49.39

–

–

28.30

Other receivables

–

–

17.38

–

–

8.82

Total financial assets

5.70

453.38

795.47

2.92

417.61

567.18

Financial liabilities

Borrowings

–

–

15.91

–

–

167.69

Trade payables

–

–

459.02

–

–

337.49

Security deposits

–

–

22.46

–

–

21.92

Derivative financial liabilities

designated as hedges

–

0.02

–

–

2.43

–

Derivative financial liabilities

not designated as hedges

–

–

–

5.07

–

–

Employee benefits payable

–

–

23.93

–

–

21.71

Creditors for capital goods

–

–

19.64

–

–

20.52

Other liabilities (includes

discount payables)

–

–

16.86

–

–

11.81

Total financial liabilities

–

0.02

557.82

5.07

2.43

581.14

Notes

to the Consolidated Financial Statements