Atul Ltd | Annual Report 2017-18

Note 29.6 Employee benefit obligations

(continued)

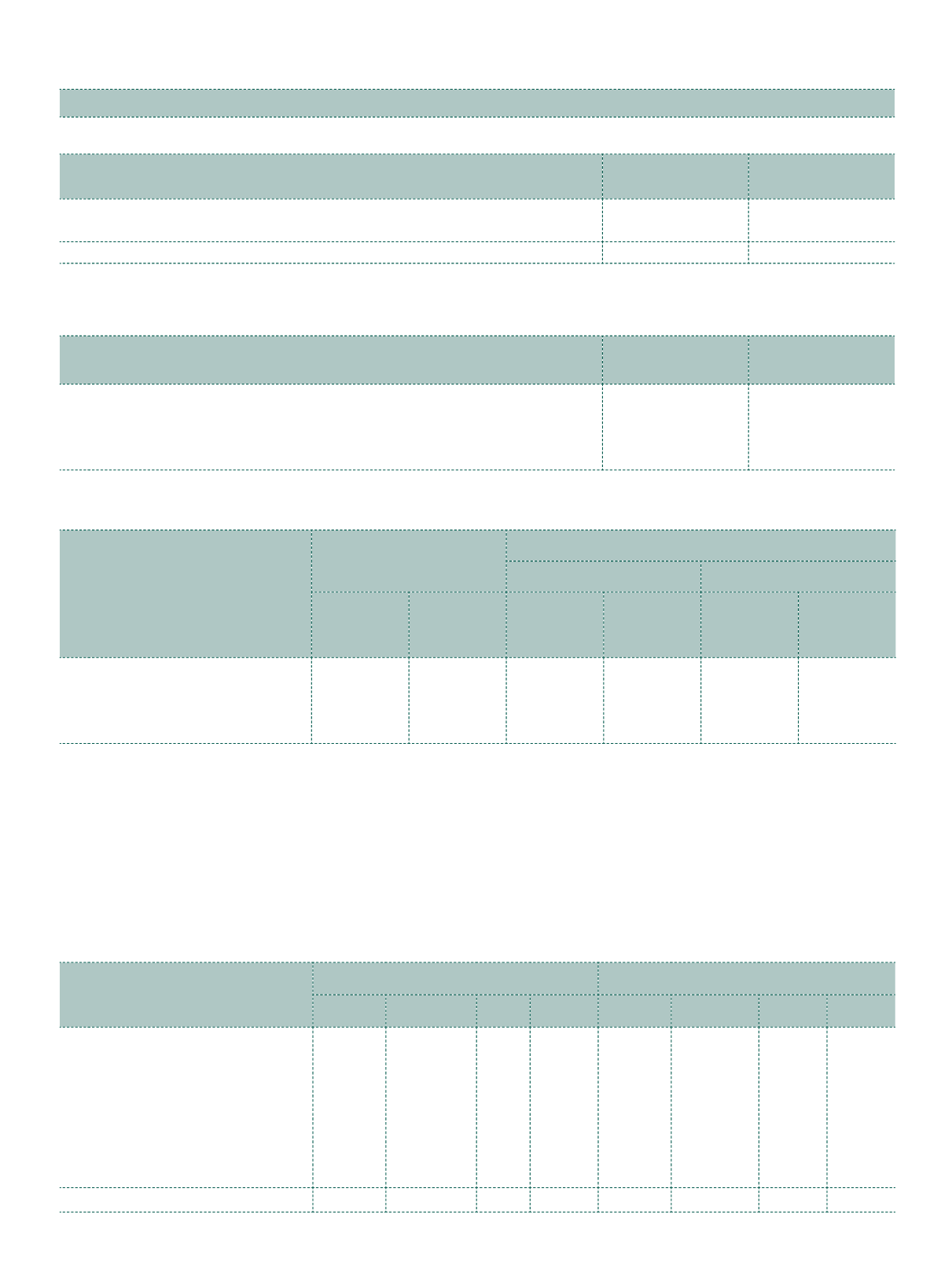

The net liability disclosed above relates to following funded and unfunded plans:

(

`

cr)

Particulars

As at

March 31, 2018

As at

March 31, 2017

Present value of funded obligations

46.50

48.09

Fair value of plan assets

(46.49)

(48.00)

Deficit of Gratuity plan

0.01

0.09

Significant estimates: Actuarial assumptions and sensitivity

The significant actuarial assumptions were as follows:

Particulars

As at

March 31, 2018

As at

March 31, 2017

Discount rate

7.68%

7.22%

Attrition rate

9.70%

7.30%

Rate of return on plan assets

7.68%

7.22%

Salary escalation rate

8.27% and 6.00%

7.75%

Sensitivity analysis

The sensitivity of the defined benefit obligation to changes in the weighted principal assumptions is:

Particulars

Change in assumptions

Impact on defined benefit obligation

Increase in assumptions

Decrease in assumptions

As at

March 31,

2018

As at

March 31,

2017

As at

March 31,

2018

As at

March 31,

2017

As at

March 31,

2018

As at

March 31,

2017

Discount rate

1.00% 1.00% (3.46%)

(3.92%)

3.78% 4.31%

Attrition rate

1.00% 1.00% (0.11%)

(0.06%)

0.12% 0.06%

Rate of return on plan assets

1.00% 1.00% (3.46%)

(3.92%)

3.78% 4.31%

Salary escalation rate

1.00% 1.00% 3.74% 4.27% (3.49%)

(3.96%)

The above sensitivity analyses are based on a change in an assumption while holding all other assumptions constant.

In practice, this is unlikely to occur, and changes in some of the assumptions may be correlated. When calculating the

sensitivity of the defined benefit obligation to significant actuarial assumptions the same method (present value of the

defined benefit obligation calculated with the projected unit credit method at the end of the reporting period) has been

applied while calculating the defined benefit liability recognised in the Consolidated Balance Sheet.

The methods and types of assumptions used in preparing the sensitivity analysis did not change as compared to the

prior year.

Major category of plan assets are as follows:

(

`

cr)

Particulars

As at March 31, 2018

As at March 31, 2017

Quoted Unquoted Total

in % Quoted Unquoted Total

in %

Government of India assets

–

1.18 1.18

2.54% –

1.27

1.27

2.67%

Debt instruments

Corporate bonds

0.98

– 0.98

2.11% 1.22

– 1.22

2.57%

Investment funds

Insurance fund

44.04

0.11 44.15 94.97% 44.71

0.13 44.84 94.42%

Others

–

0.02 0.02

0.04% –

–

–

–

Special deposit scheme

–

0.16 0.16

0.34% –

0.16

0.16

0.34%

45.02

1.47 46.49

100% 45.93

1.56 47.49

100%

Notes

to the Consolidated Financial Statements