Atul Ltd | Annual Report 2016-17

(

`

cr)

Expenses recognised for the year ended March 31, 2017

(included in Note 26)

As at

March 31, 2017

As at

March 31, 2016

As at

April 01, 2015

i)

Defined benefit obligation

9.14

11.39

10.14

ii)

Fund

9.16

11.50

10.40

iii)

Net asset | (liability)

0.03

0.11

0.26

iv)

Charge to the Consolidated Statement of Profit and Loss

during the year

0.20

0.15

0.23

d)

Compensated absences amount of

`

6.02 cr (March 31, 2016:

`

3.42 cr) is recognised as expense and included in the

Note 26 ' Salaries, wages and bonus.'

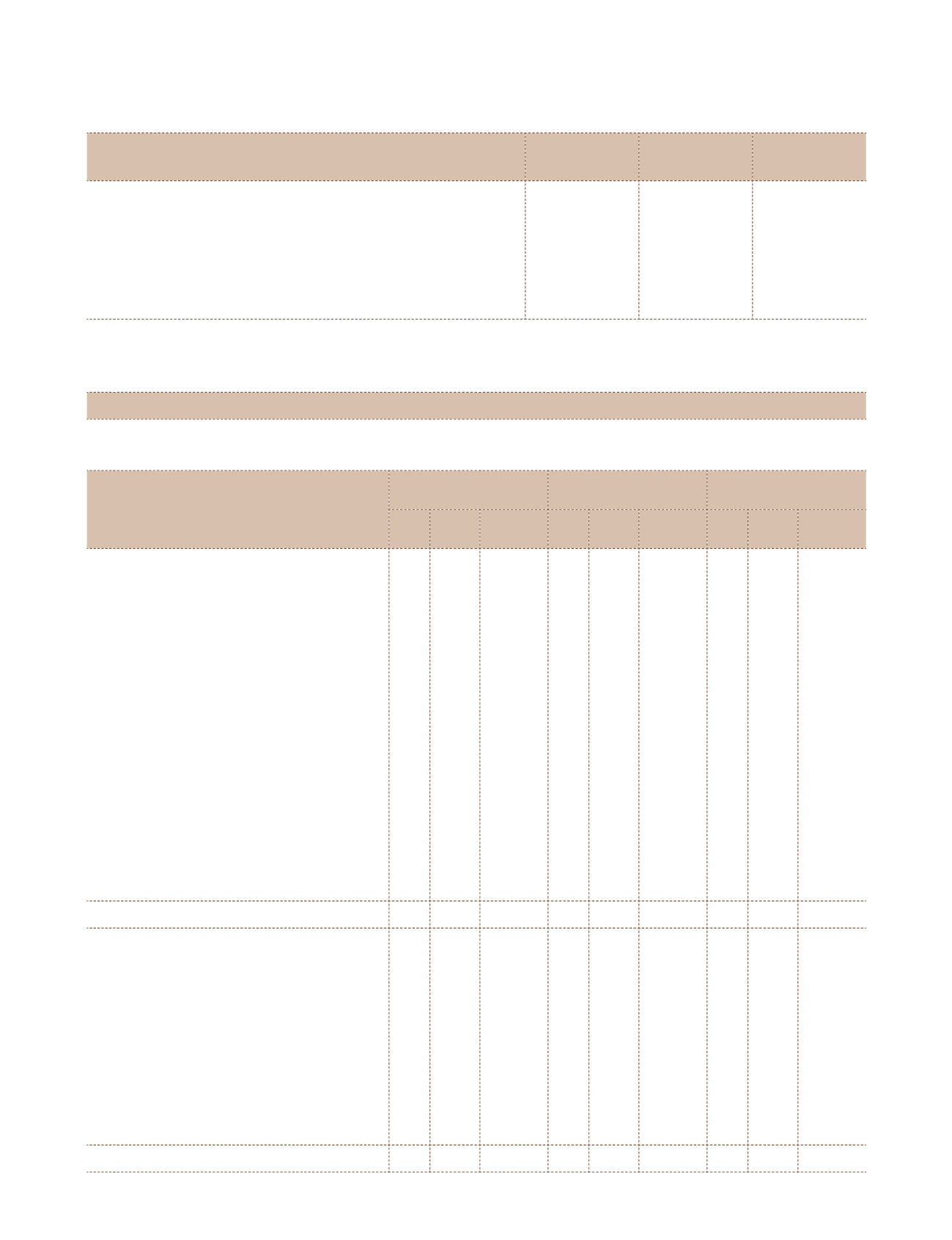

Note 29.7 Fair value measurements

Financial instruments by category

(

`

cr)

Particulars

As at

March 31, 2017

As at

March 31, 2016

As at

April 01, 2015

FVPL FVOCI Amortised

cost

FVPL FVOCI Amortised

cost

FVPL FVOCI Amortised

cost

Financial assets

Investments:

Equity instruments

– 415.10

–

– 337.78

–

– 376.40

–

Preference shares

–

–

–

–

–

6.43

–

–

5.81

Mutual funds

2.92

–

– 2.05

–

– 2.66

–

–

Government securities

–

–

0.11

–

–

0.01

–

–

0.01

Trade receivables

–

–

518.96

–

–

441.39

–

–

439.16

Loans

–

–

–

–

–

9.40

–

–

7.88

Security deposits for utilities and premises

–

–

1.59

–

–

1.39

–

–

1.49

Dividend receivable

–

–

9.40

–

–

–

–

–

–

Derivative financial assets designated as hedges

– 1.70

–

– 0.44

–

– 0.28

–

Cash and bank balances

–

–

28.30

–

–

22.01

–

–

34.61

Other receivables

–

–

8.41

–

–

9.75

–

–

10.88

Total financial assets

2.92 416.80

566.77 2.05 338.22

490.38 2.66 376.68

499.84

Financial liabilities

Borrowings

–

–

167.69

–

–

315.82

–

–

296.60

Trade payables

–

–

337.49

–

–

315.12

–

–

278.21

Security deposits

–

–

21.92

–

–

21.32

–

–

17.74

Derivative financial liabilities designated as hedges

– 2.43

–

– 1.34

–

– 0.56

–

Derivative financial liabilities not designated as hedges 5.07

–

– 2.23

–

–

–

–

–

Capital creditors

–

–

20.52

–

–

18.33

–

–

9.93

Other liabilities (Includes discount payables)

–

–

11.81

–

–

14.64

–

–

15.60

Total financial liabilities

5.07

2.43

559.43 2.23

1.34

685.23

–

0.56

618.08

Notes

to the Consolidated Financial Statements