193

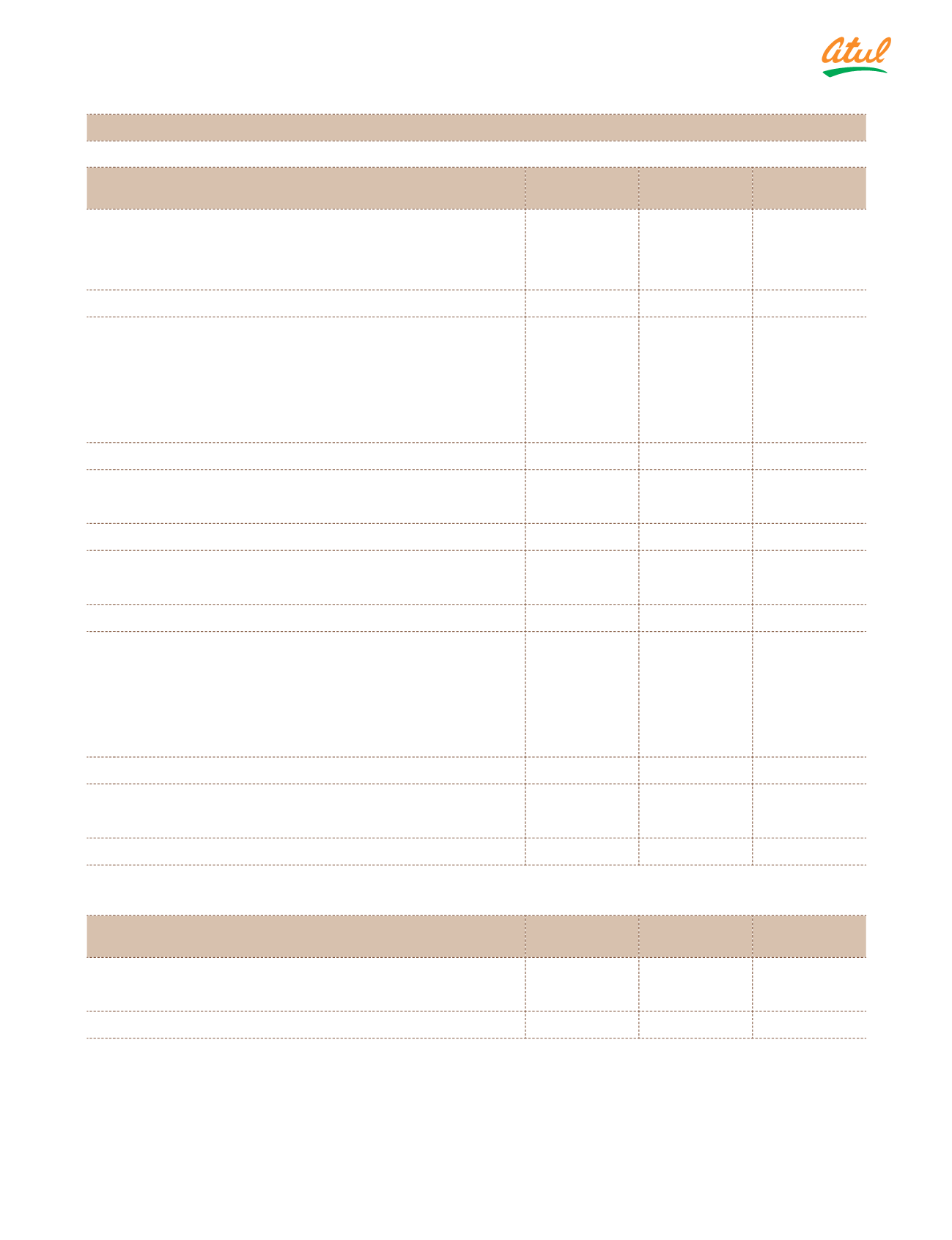

Note 29.6 Employee benefit obligations

Balance Sheet amount (Gratuity)

(

`

cr)

Particulars

Present value of

obligation

Fair value of

plan assets

Net amount

April 01, 2015

44.92

(44.47)

0.45

Current service cost

2.21

–

2.21

Interest expense | (income)

3.59

(3.59)

–

Total amount recognised in profit and loss

5.80

(3.59)

2.21

Remeasurements

Return on plan assets, excluding amount included in interest

expense | (income)

–

0.79

0.79

(Gain) | Loss from change in financial assumptions

0.36

–

0.36

Experience (gain) | loss

1.83

–

1.83

Total amount recognised in Other Comprehensive Income

2.19

0.79

2.98

Employer contributions

–

(5.17)

(5.17)

Benefit payments

(5.10)

5.08

(0.02)

March 31, 2016

47.81

(47.36)

0.45

Current service cost

2.64

(0.01)

2.63

Interest expense | (income)

3.73

(3.73)

–

Total amount recognised in profit and loss

6.37

(3.74)

2.63

Remeasurements

Return on plan assets, excluding amount included in interest

expense | (income)

0.01

(1.98)

(1.97)

(Gain) | Loss from change in financial assumptions

1.16

–

1.16

Experience (gain) | loss

(1.63)

–

(1.63)

Total amount recognised in Other Comprehensive Income

(0.46)

(1.98)

(2.44)

Employer contributions

–

0.01

0.01

Benefit payments

(5.85)

5.77

(0.08)

March 31, 2017

47.87

(47.30)

0.57

The net liability disclosed above relates to funded and unfunded plans are as follows:

(

`

cr)

Particulars

As at

March 31, 2017

As at

March 31, 2016

As at

April 01, 2015

Present value of funded obligations

47.87

47.81

44.92

Fair value of plan assets

(47.30)

(47.36)

(44.47)

Deficit of Gratuity plan

0.57

0.45

0.45

Notes

to the Consolidated Financial Statements