199

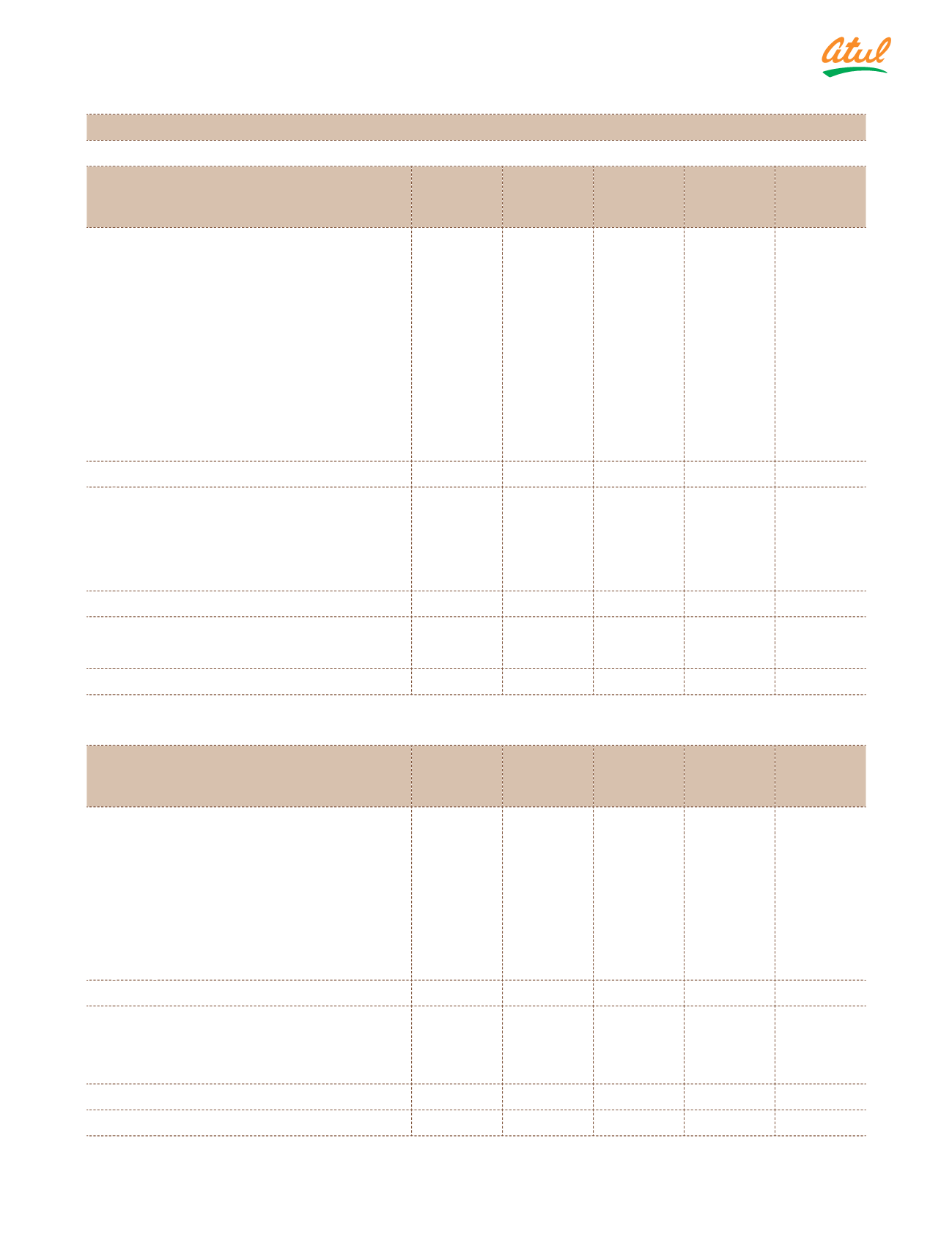

Note 29.7 Fair value measurements

(continued)

(

`

cr)

v)

Assets and liabilities measured

at fair value – recurring fair value

measurements at April 01, 2015

Note

Level 1

Level 2

Level 3

Total

Financial assets

Financial investment at FVPL:

Mutual funds

11

2.66

–

–

2.66

Financial investments at FVOCI:

Quoted equity instruments

6

376.37

–

–

376.37

Unquoted equity instruments

6

–

–

0.03

0.03

Derivatives designated as hedges:

Foreign exchange forward contracts

–

0.01

–

0.01

Currency options

–

0.27

–

0.27

Total financial assets

379.03

0.28

0.03

379.34

Financial liabilities

Derivatives designated as hedges:

Foreign exchange forward contracts

–

0.45

–

0.45

Interest rate swaps

–

0.11

–

0.11

Total financial liabilities

–

0.56

–

0.56

Biological assets

Tissue culture raised date palms

–

7.24

–

7.24

Total biological assets

–

7.24

–

7.24

(

`

cr)

vi) Assets and liabilities for which fair

values are disclosed at April 01,

2015

Note

Level 1

Level 2

Level 3

Total

Financial assets

Investments:

Preference shares

6

5.81

5.81

Government securities

6

0.01

–

–

0.01

Loans

7

–

–

7.88

7.88

Security deposits for utilities and

premises

8

–

–

1.49

1.49

Total financial assets

0.01

–

15.18

15.19

Financial liabilities

Borrowings

17

–

–

293.08

293.08

Security deposits

18

–

–

17.74

17.74

Total financial liabilities

–

–

310.82

310.82

Investment properties

3

–

–

130.00

130.00

There were no transfers between any levels during the year.

Notes

to the Consolidated Financial Statements