12 /

Atul Ltd |

Annual Report 2009-10

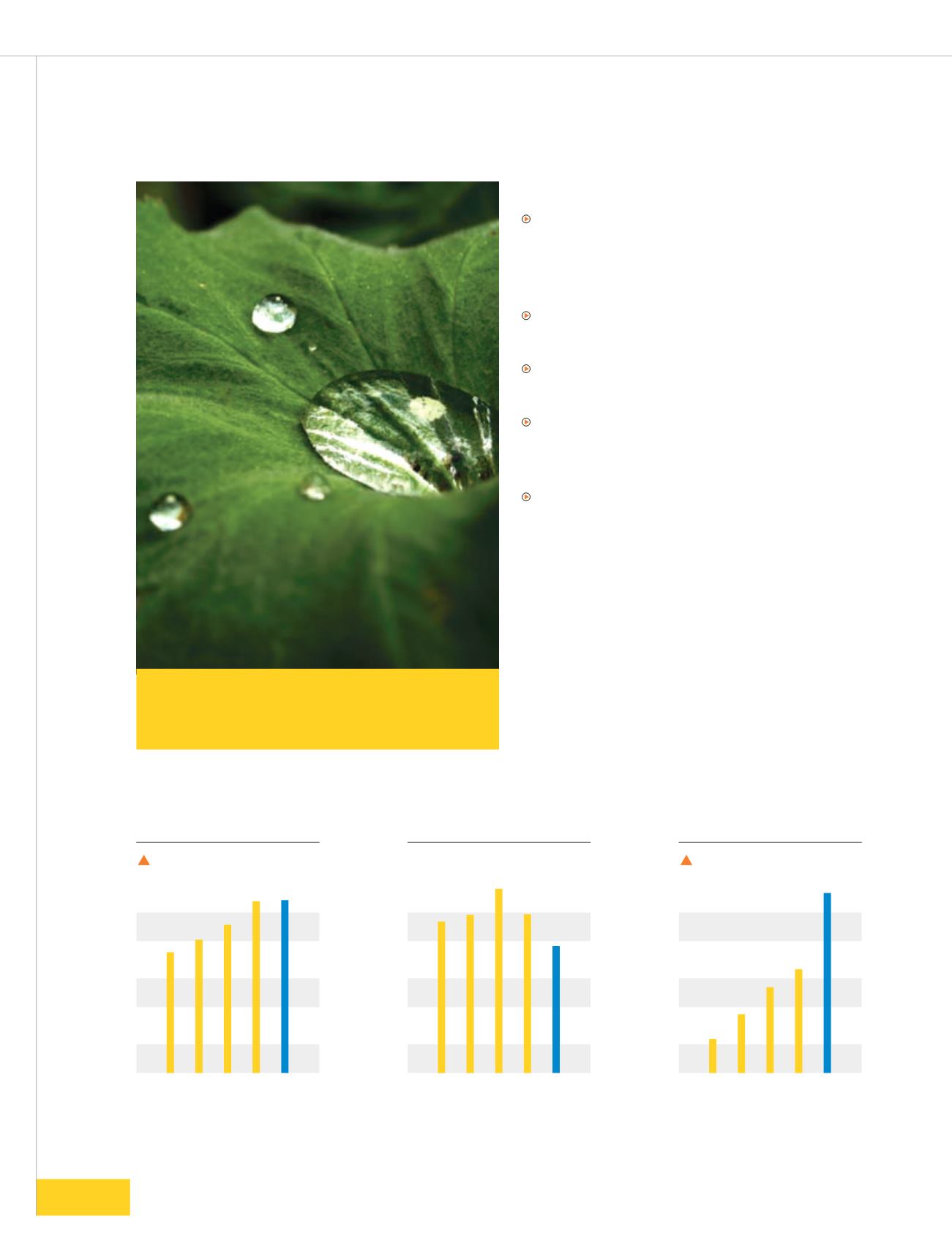

Financial Analysis

Highlights

Sales volume on an average grew by 18%, though

remained stagnant in value mainly because

of a decline in the prices of raw materials and

consequently those of finished products

Surplus operating cash-flows helped to reduce debt

by Rs 73 crores (20%) to Rs 295 crores

Interest cost decreased by 38% to Rs 26 crores owing

to lower interest rates and reduction in debt

Profit before tax (PBT) increased by 75% to Rs 80

crores mainly due to lower loss on account of foreign

exchange fluctuations

Despite increase in income tax by 170%, profit after

tax increased by 47% to Rs 53 crores

Sources of Funds

Share Capital

The Company has a paid up share capital of Rs 29.67

crores comprising 2,96,61,733 equity shares of Rs 10

each as of March 31, 2010.

2005-06

349

369

428

368

295

2006-07

2007-08

2008-09

2009-10

Borrowings

Rs Crores

* Year 2005-06 PBT excludes profit

from sale of investments Rs 68 crores

13

2005-06

2006-07

2007-08

2008-09

2009-10

PBT

Rs Crores

80

15*

26

38

46

CAGR 33%

2005-06

837

925

1033

1196

1204

2006-07

2007-08

2008-09

2009-10

Revenues

Rs Crores

CAGR 11%