Corporate Identity Serving Diverse Industries Purpose and Values Overview by the Chairman Operational Highlights

Financial Analysis

Research and Technology

Safety, HealthandEnvironment Serving the Society Directors’ Report Management Discussion andAnalysis Report on Corporate Governance Financial Statements

Reserves and Surplus

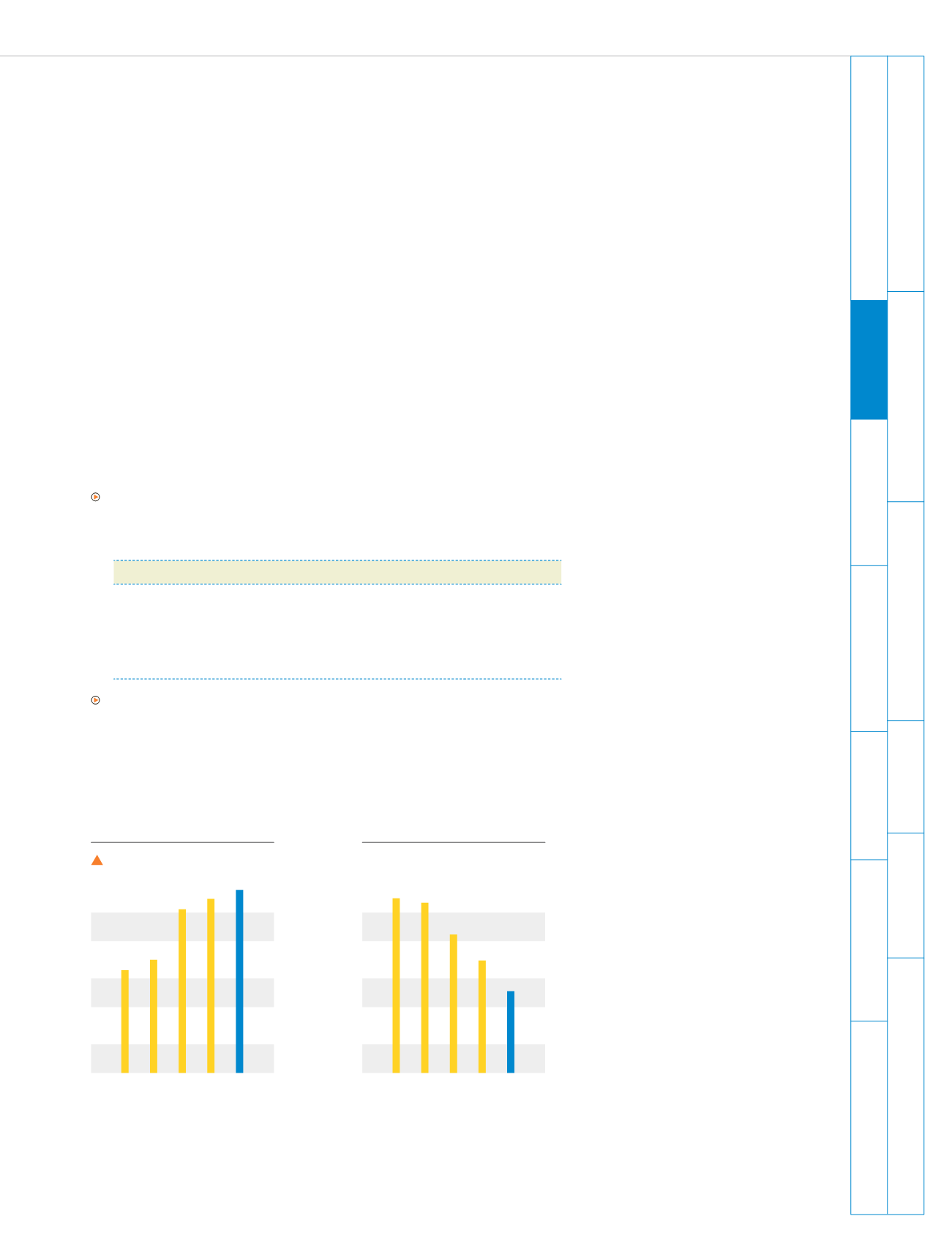

The reserves and surplus increased by 6% from Rs 429 crores to Rs 455 crores

during the year owing to profit earned.

Loan Funds

The reliance on external funds decreased by 20% from Rs 368 crores to Rs

295 crores due to utilisation of cash generated from operations to repay debts

along with control over working capital levels. Secured loans constituted

88% of the total loans. Of the secured loans, 19% was for funding working

capital requirements; the balance was used in projects. Foreign currency loans

constituted 22% of the total debt. The Company remained reasonably geared

with the ratio of total debt to total equity at 0.56:1.

Applications of Funds

Fixed Assets

Additions to Fixed Assets

During the year, the Company invested Rs 25 crores in Fixed Assets. The

business-wise spends are outlined below:

Business

Rs Crores

Pharmaceuticals and Intermediates

9

Bulk Chemicals and Intermediates

4

Colors

3

Others

9

Depreciation

Depreciation increased by 18% over the previous year, corresponding to the

increase in plant, machinery and building. Cumulative depreciation as a part

of total gross block was 58%.

2005-06

2006-07

2007-08

2008-09

2009-10

Debt-equity ratio

Rs Crores

0.56

1.20

1.17

0.95

0.77

2005-06

2006-07

2007-08

2008-09

2009-10

Reserves and Surplus

Rs Crores

455

243

270

403

429

CAGR 22%