109

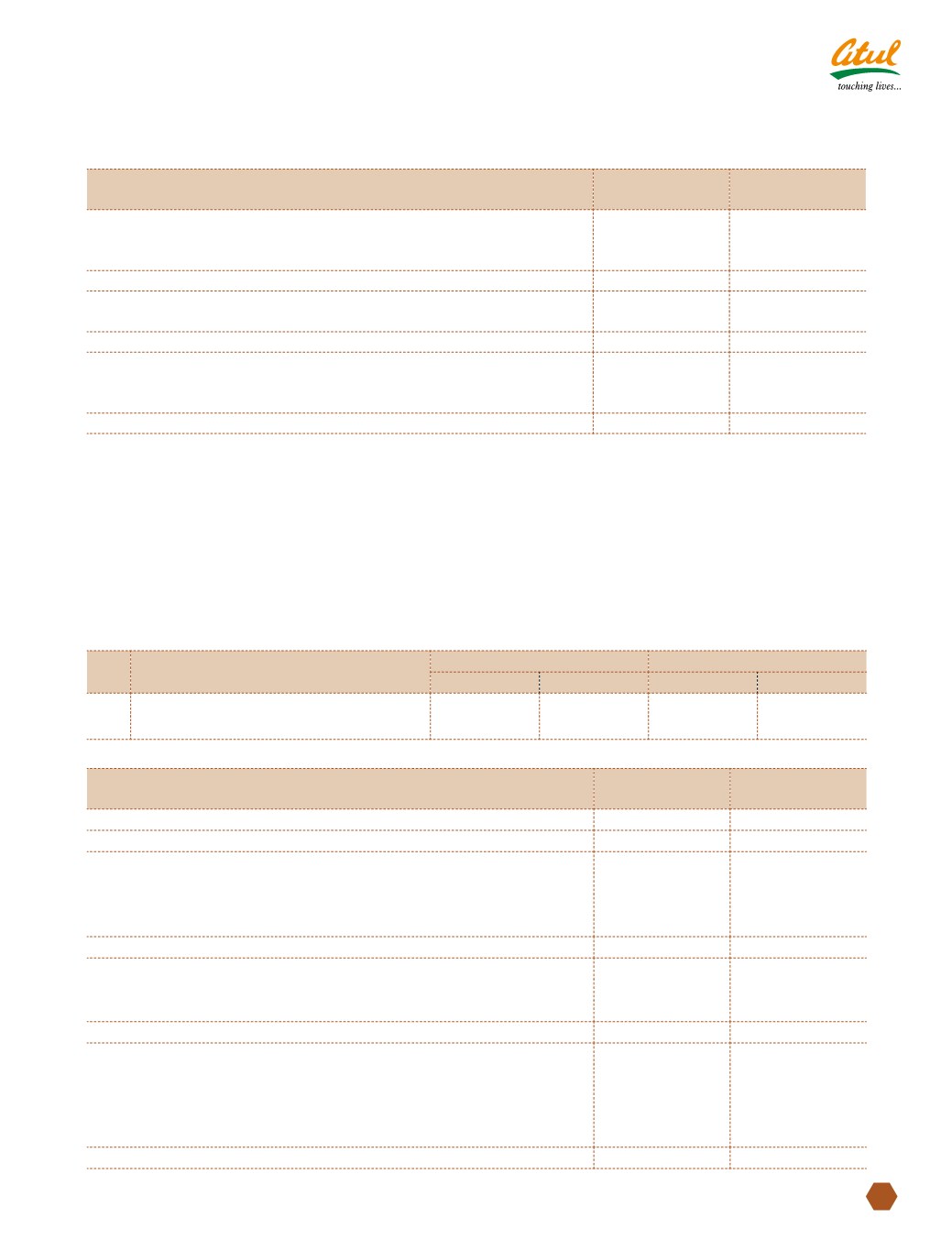

NOTE 2 SHARE CAPITAL

As at

March 31, 2012

As at

March 31, 2011

Authorised

8,00,00,000 Equity Shares of

`

10 each

80.00

80.00

80,00,000 Cumulative Redeemable Preference Shares of

`

100 each

80.00

80.00

160.00

160.00

Issued

2,96,91,780 Equity Shares of

`

10 each

29.69

29.69

29.69

29.69

Subscribed

2,96,61,733 Equity Shares of

`

10 each, fully paid

29.66

29.66

Add: Forfeited shares (amount paid-up)

0.02

0.02

29.68

29.68

The Company has two classes of shares referred to as Equity Shares having a par value of

`

10 and Cumulative

Redeemable Preference Shares having a par value of

`

100.

In the event of liquidation of the Company, the holders of Equity Shares will be entitled to receive any of the

remaining assets of the Company, after distribution of all preferential amounts. The distribution will be in proportion

to the number of Equity Shares held by the Shareholders.

Each holder of Equity Shares is entitled to one vote per share.

The Company declares and pays dividends in Indian rupees. The dividend proposed by the Board of Directors is

subject to the approval of the Shareholders in the ensuing Annual General Meeting.

Details of Shareholders holding more than 5% of Equity Shares:

Sr

No

Name of the Shareholder

As at March 31, 2012

As at March 31, 2011

Holding % No of shares Holding % No of shares

1 Aeon Investments Pvt Ltd

5.9% 17,64,382

5.9% 17,64,382

2 Aura Securities Pvt Ltd

5.4% 16,14,045

5.4% 16,14,045

(

`

cr)

NOTE 3 RESERVES AND SURPLUS

As at

March 31, 2012

As at

March 31, 2011

(a) Capital reserve

11.70

6.68

(b) Securities premium account

36.27

34.66

(c) Central and State subsidy reserve:

Balance as at the beginning of the year

6.63

6.63

Add: Received during the year

-

-

Less: Transferred to general reserve

-

-

6.63

6.63

(c) Revaluation reserve:

Balance as at the beginning of the year

108.58

110.64

Less: Transferred to Statement of Profit and Loss

2.06

2.06

Balance as at the end of the year

106.52

108.58

(d) Hedging reserve (see Note 27.4):

Balance as at the beginning of the year

(5.09)

(15.03)

Add: Transferred to Statement of Profit and Loss

5.09

15.03

Less: Effect of foreign exchange rate variation on hedging

instruments outstanding at the end of the year

0.78

5.09

Balance as at the end of the year

(0.78)

(5.09)

(

`

cr)

Notes

to Consolidated financial statements