111

(

`

cr)

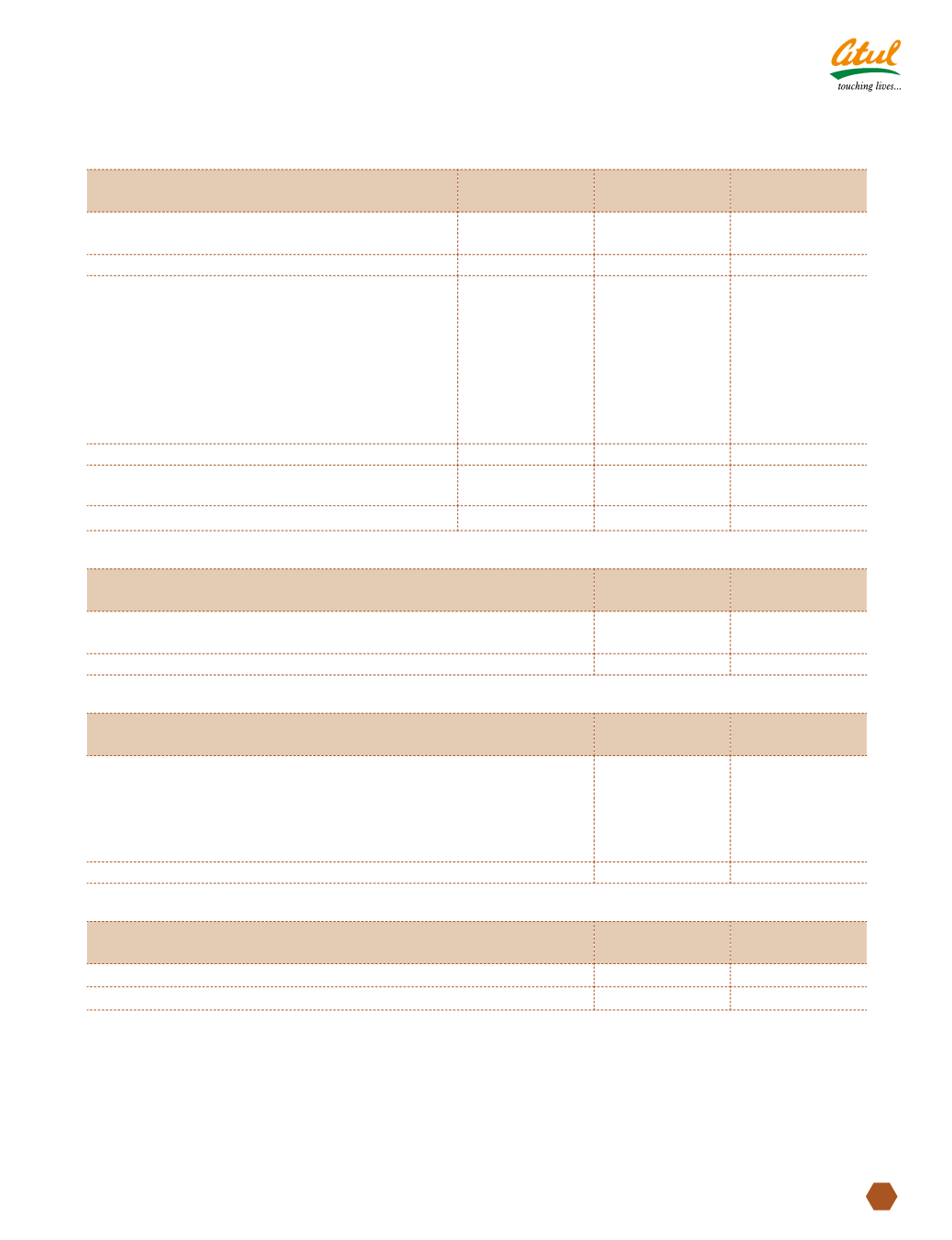

NOTE 5 DEFERRED TAX LIABILITIES (NET)

As at

March 31, 2012

Charge | (credit)

during the year

As at

March 31, 2011

Deferred tax liabilities:

on account of timing difference in depreciation

29.41

0.54

28.87

29.41

0.54

28.87

Deferred tax assets:

on account of timing difference in

(a) Provision for leave encashment

5.86

1.17

4.69

(b) Provision for doubtful debts

0.39

0.25

0.14

(c) Provision for doubtful advances

0.06

-

0.06

(d) Voluntary retirement scheme

0.40

(0.52)

0.92

(e) Expenses disallowed under Section 40 (ia)

of the Income Tax Act, 1961

0.39

0.39

-

7.10

1.29

5.81

(f) Deferred tax liabilities | (assets) of subsidiary

companies

0.46

0.48

(0.02)

Net deferred tax liabilities | (assets)

22.77

(0.27)

23.04

(

`

cr)

NOTE 6 LONG-TERM PROVISIONS

As at

March 31, 2012

As at

March 31, 2011

Provision for leave entitlement

3.51

2.60

Gratuity

0.03

-

3.54

2.60

(

`

cr)

NOTE 7 SHORT-TERM BORROWINGS

As at

March 31, 2012

As at

March 31, 2011

(a) Secured

Loans repayable on demand from banks

152.89

79.19

(b) Unsecured

Loans from banks

25.07

20.00

(c) Buyers’ credit arrangement

22.71

62.08

200.67

161.27

(

`

cr)

NOTE 8 TRADE PAYABLES

As at

March 31, 2012

As at

March 31, 2011

(a) Trade payables including acceptances

266.63

234.92

266.63

234.92

Notes

to Consolidated financial statements