113

Notes

to Consolidated financial statements

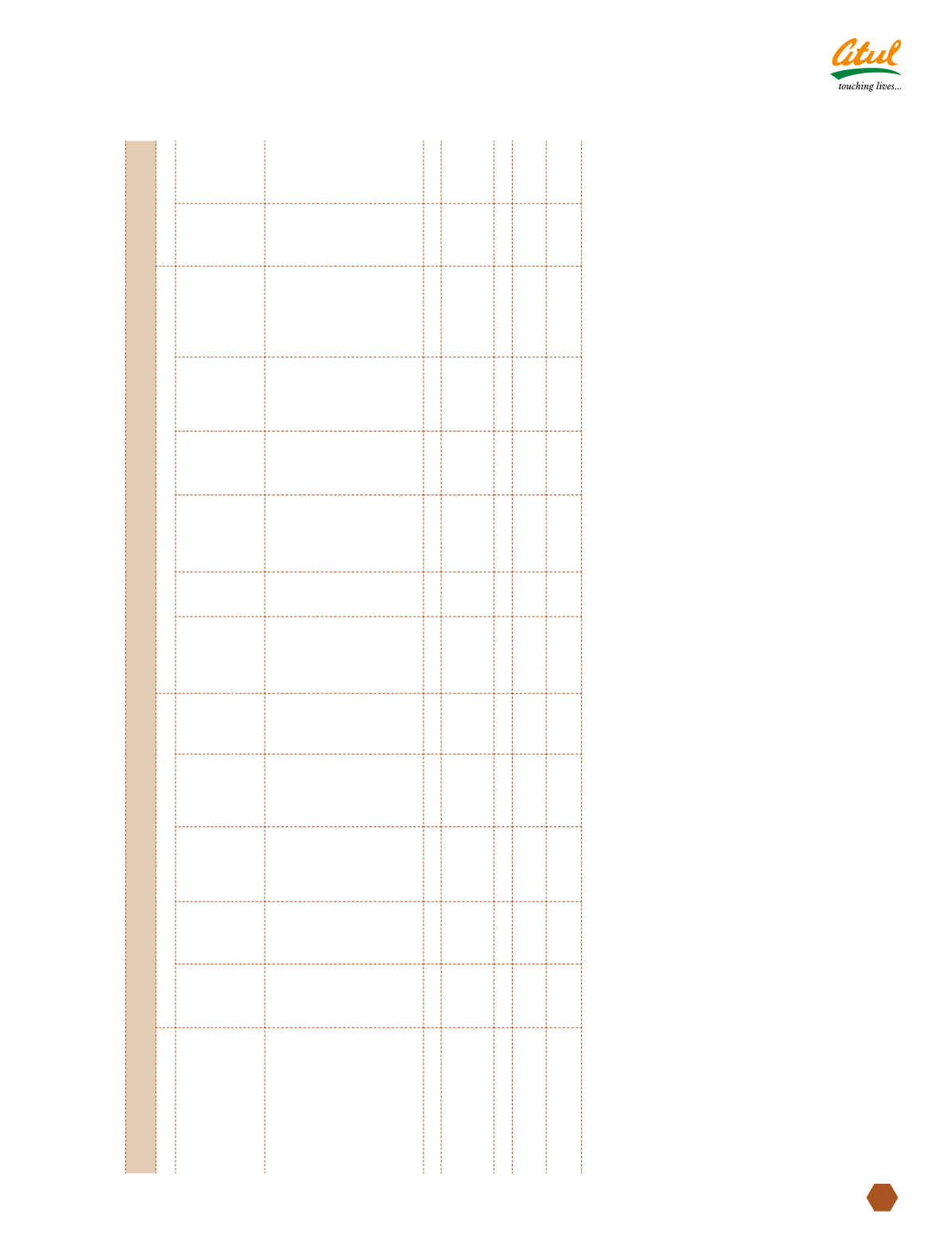

NOTE 11 FIXED ASSETS

ASSET BLOCK

GROSS BLOCK (a)

DEPRECIATION | AMORTISATION | IMPAIRMENT

NET BLOCK

As at

March 31,

2011

Additions

Other

Adjustments

Deductions

and

Adjustments

As at

March 31,

2012

Depreciation

upto

March 31,

2011

For the

year

Deductions

and

Adjustments

As at

March 31,

2012

Impairment

Fund

March 31,

2012

Depreciation

and

Impairment

Fund

March 31, 2012

As at

March 31,

2012

As at

March 31,

2011

Tangible assets

Land - Freehold (d) and (e)

13.11

1.26

-

-

14.37

-

-

-

-

-

-

14.37

13.11

Land - Leasehold (b), (d) and (e)

23.45

-

-

0.28

23.17

-

-

-

-

-

-

23.17

23.45

Buildings (c), (d) and (e)

220.69

22.04

-

-

242.73

54.95 6.14

-

61.09

-

61.09

181.64

165.74

Roads

2.34

0.76

-

-

3.10

1.19 0.05

-

1.24

-

1.24

1.86

1.15

Plant and equipment (f)

670.31

74.96

1.59

5.24

741.62

475.00 38.55

-

513.55

21.03

534.58

207.04

174.28

Railway siding

0.08

-

-

-

0.08

0.08

-

-

0.08

-

0.08

-

-

Office equipment and furniture

23.10

2.41

-

0.02

25.49

15.91 1.66

-

17.57

-

17.57

7.92

7.19

Vehicles

11.78

3.95

-

2.16

13.57

6.99 1.69

1.44

7.24

-

7.24

6.33

4.79

Total Tangible assets

964.86

105.38

1.59

7.70 1,064.13

554.12 48.09

1.44

600.77

21.03

621.80

442.33

389.71

Intangible assets

Copyright

-

1.10

-

-

1.10

- 0.06

-

0.06

-

0.06

1.04

-

Computer software

8.23

1.91

-

-

10.14

7.41 2.47

-

9.88

-

9.88

0.26

0.81

Total Intangible assets

8.23

3.01

-

-

11.24

7.41 2.53

-

9.94

-

9.94

1.30

0.81

Total as at

March 31, 2012

973.09

108.39

1.59

7.70 1,075.37

561.53 50.62

1.44

610.71

21.03

631.74

443.63

390.52

Total as at

March 31, 2011

975.20

22.52

-

24.36

973.36

535.04 40.42

13.65

561.81

21.03

582.84

390.52

Notes:

(a) At cost, except land - freehold, certain leasehold land, building premises and plant and equipment stated at revalued value.

(b) Land - leasehold at cost less amounts written off.

(c) Includes premises on ownership basis

`

1.10 cr (Previous year

`

1.10 cr) and cost of fully paid share in co-operative society

`

2,000 (Previous year

`

2,000).

(d) The Company has revalued (i) Leasehold land and (ii) Commercial land & building at Ahmedabad, Mumbai and Delhi as at March 31, 2008 at fair market value as determined by an

independent valuer appointed for the purpose. Resultant increase in book value amounting to

`

107.47 cr has been transferred to Revaluation reserve.

(e) Pursuant to the order passed by Honourable High Court of Gujarat, dated November 17, 2008 and April 17, 2009 in case of water charges , the Company has created first charge

over its certain land & buildings in favour of Government of Gujarat.

(f) The Company has opted to recognise exchange differences arising on reporting of long-term foreign currency monetary items in line with paragraph 46 of Accounting Standard-11

‘The effects of changes in foreign exchange rates’ inserted vide Notification dated December 29, 2011 issued by the Ministry of Corporate Affairs. Pursuant to the above, the effect

of exchange differences on long-term foreign currency monetary items, so far as they relate to acquisition of depreciable capital assets, are amortised over the remaining life of such

assets. Had the Company continued to follow the earlier Accounting Policy, the net foreign exchange loss recognised in the Statement of Profit and Loss would have been higher by

`

1.89 cr and Fixed Assets would have been lower by

`

1.89 cr.

(

`

cr)