Atul Ltd | Annual Report 2011-12

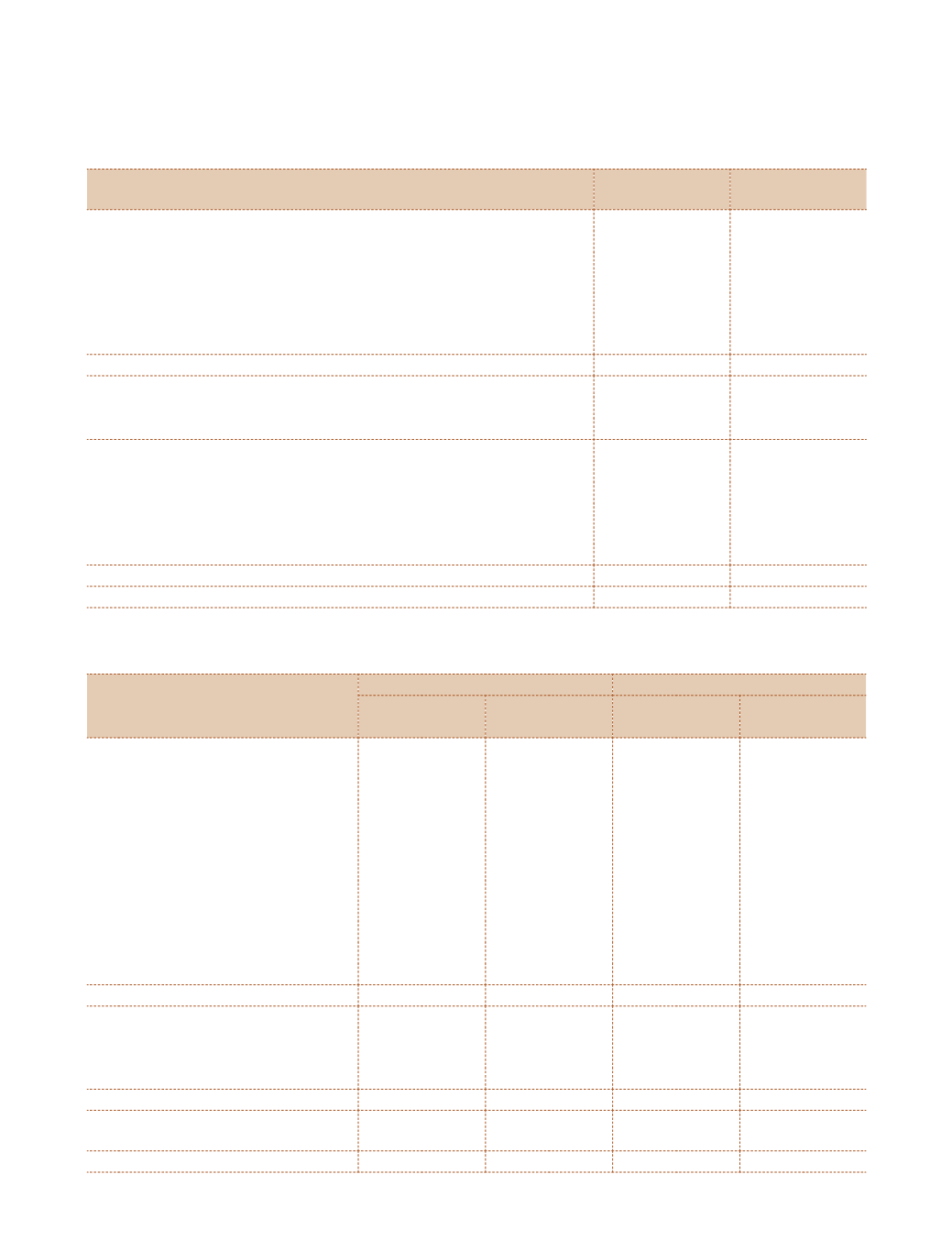

NOTE 3 RESERVES AND SURPLUS

As at

March 31, 2012

As at

March 31, 2011

(e) General reserve:

Balance as at the beginning of the year

55.16

49.37

Add: Transferred from unclaimed amount of fractional coupons of

bonus shares

-

0.11

Less: Investment in associate company now tranferred on becoming

subsidiary company

(0.97)

-

Add: Transferred from Statement of Profit and Loss

8.81

5.68

Balance as at the end of the year

63.00

55.16

(f) Surplus in Statement of Profit and Loss:

Balance as at the beginning of the year

334.27

265.22

Add: Profit for the year

91.10

90.25

Amount available for appropriation

425.37

355.47

Less: Appropriations

General reserve

8.81

5.68

Proposed dividend on Equity Shares for the year

{at

`

4.50 per share (March 31, 2011

`

4.50 per share)}

13.35

13.35

Dividend distribution tax on proposed dividend

2.17

2.17

Balance as at the end of the year

401.04

334.27

624.38

540.89

(

`

cr)

NOTE 4 LONG-TERM BORROWINGS

Non-current

Current

As at

March 31, 2012

As at

March 31, 2011

As at

March 31, 2012

As at

March 31, 2011

(a) Term loans

Secured:

(i) Rupee term loans from banks

16.41

29.08

19.04

26.08

(ii) Rupee term loans from

financial institutions

52.08

62.50

13.13

10.42

(iii) Foreign currency term loans

from banks

20.78

-

4.80

15.41

(iv) Foreign currency term loans

from financial institutions

61.81

11.16

2.14

-

Unsecured:

(v) Rupee term loans from banks

0.09

-

0.02

-

151.17

102.74

39.13

51.91

(b) Deposits, unsecured:

(i) Public deposits from related

parties

-

0.83

0.83

0.01

(ii) Public deposits from others

-

6.79

6.66

3.67

-

7.62

7.49

3.68

Amount disclosed under the head

‘Other Current Liabilities’ (see Note 9)

(46.62)

(55.59)

151.17

110.36

-

-

(

`

cr)

Notes

to Consolidated financial statements