Atul Ltd | Annual Report 2011-12

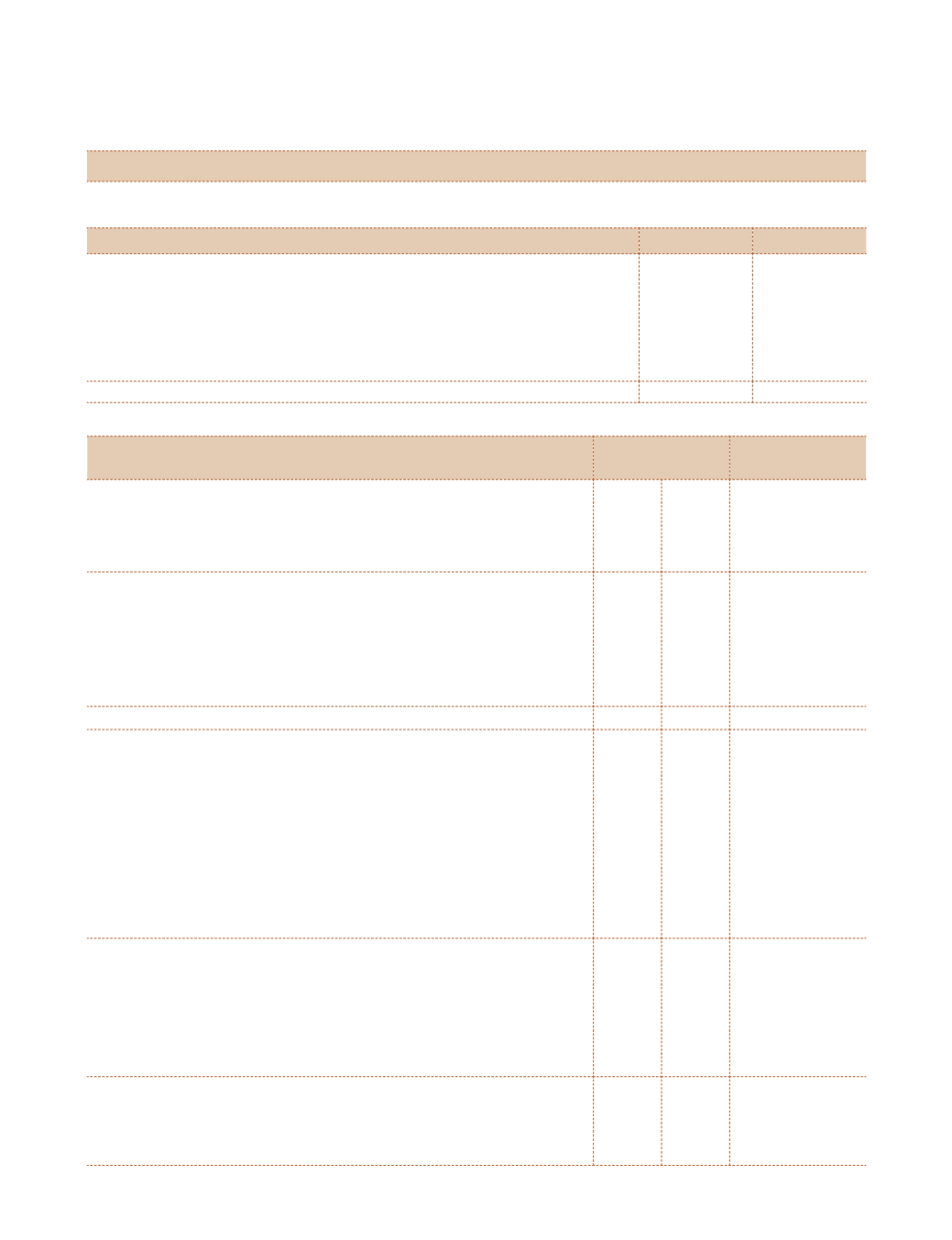

(g) Break-up of depreciation for the year

(

`

cr)

2011-12

2010-11

Depreciation | Amortisation for the year

50.62

40.42

Add: Amortisation of Leasehold land

0.28

0.28

Less: Amount withdrawn from Revaluation reserve (see Note 3)

2.06

2.06

Less: Depreciation on acquisition of Atul Bioscience Ltd

2.71

-

Less: Depreciation on acquisition of DPD Ltd

2.04

-

Less: Depreciation on proportionate consolidation of Rudolf Atul Chemicals Ltd

0.07

-

Depreciation | Amortisation as per Statement of Profit and Loss

44.02

38.64

(

`

cr)

NOTE 12 NON-CURRENT INVESTMENTS*

As at

March 31, 2012

As at

March 31, 2011

Trade Investments, unquoted

Investments in Equity Instruments

Bharuch Enviro Infrastructure Ltd

0.07

0.07

Narmada Clean Tech Ltd

0.65

0.65

Other investments

0.72

0.72

Investments in Equity Instruments, Quoted

In Associate Companies

Amal Ltd

0.64

0.64

Less: Cost of investments adjusted to general reserve as loss in

associate company exceed the cost

0.24

0.24

Less: Provision for diminution in value

0.40

0.40

-

-

In Others

Novartis India Ltd

1.02

1.02

Arvind Ltd (refer Note 27.15)

46.64

46.64

ICICI Bank Ltd

0.14

0.14

Wyeth Ltd

1.50

1.50

BASF India Ltd

0.84

0.84

Jain Irrigation Systems Ltd****

0.02

0.02

Nagarjuna Oil Refinery Ltd ***

-

-

50.16

50.16

Investments in Equity Instruments, Unquoted

In Associate Companies

Atul Bioscience Ltd

Cost of acquisition (net of capital reserve of

`

Nil, Previous year

`

0.91 cr)

-

2.75

Add: Group share of profits for the year

-

0.54

-

3.29

AtRo Ltd

0.50

0.50

Less: Cost of investments adjusted to general reserve as loss in

associate company exceed the cost

0.50

0.50

Notes

to Consolidated financial statements

NOTE 11 FIXED ASSETS

(contd)