24

Financial analysis

Accounting policy

The Company follows the mercantile

system of accounting and recognises

income and expenditure on an accrual

basis except those with significant

uncertainties.

Highlights of the year

Operating revenues grew by 17% to

Rs1181 crores

EBIDTA increased by 18% to Rs118

crores

Borrowings decreased by 14% to

Rs368 crores

Profit after tax remained unchanged at

Rs36 crores mainly because of higher

tax and provision for adverse exchange

rates

Working capital decreased by 12% to

Rs313 crores

Revenues

The Company registered 17% growth in

operating revenues primarily owing to an

increased focus on growing the share of

value-added products and brand sales in

the total revenues.

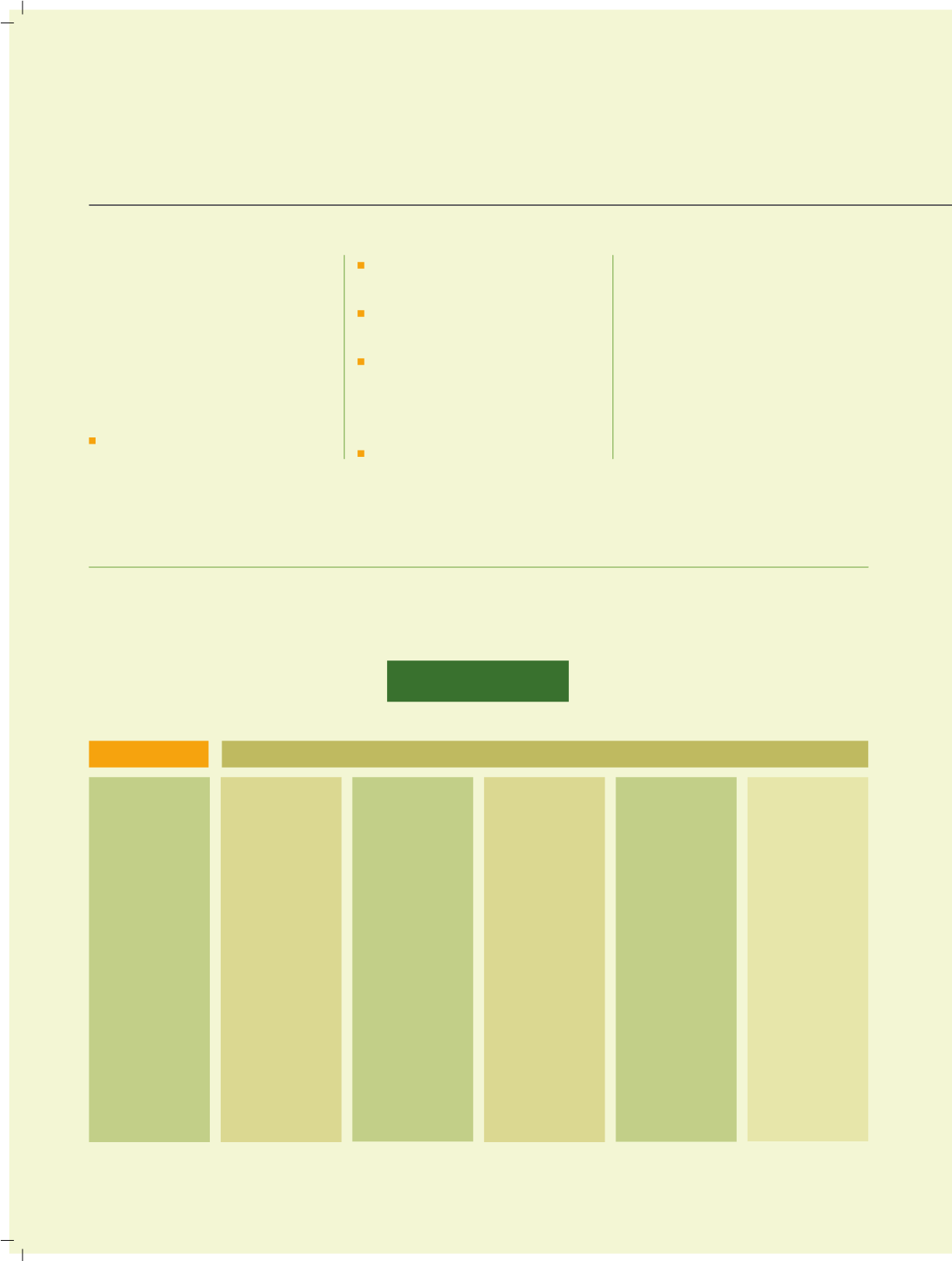

Revenue analysis

Colors segment

Specialty & Other Chemicals segment

Aromatics

Operating revenues

(Rs crores):

302

% growth over the

previous year:

39

% share as a part

of the Company

revenues:

26

Export (Rs crores):

200

%

of

export

growth over the

previous year:

44

Bulk

Chemicals &

Intermediates

Operating revenues

(Rs crores):

81

% growth over the

previous year:

13

% share as a part

of the Company

revenues:

7

Export (Rs crores):

18

%

of

export

growth over the

previous year:

51

Colors

Operating revenues

(Rs crores):

262

% growth over the

previous year:

1

% share as a part

of the Company

revenues:

22

Export (Rs crores):

118

%

of

export

growth over the

previous year:

(15)

Crop

Protection

Operating revenues

(Rs crores):

250

% growth over the

previous year:

22

% share as a part

of the Company

revenues:

21

Export (Rs crores):

145

%

of

export

growth over the

previous year:

36

Pharma &

Intermediates

Operating revenues

(Rs crores):

74

% growth over the

previous year:

12

% share as a part

of the Company

revenues:

6

Export (Rs crores):

59

%

of

export

growth over the

previous year:

12

Polymers

Operating revenues

(Rs crores):

194

% growth over the

previous year:

1

% share as a part

of the Company

revenues:

16

Export (Rs crores):

35

%

of

export

growth over the

previous year:

(28)