26

of free reserves. Of the total equity

capital, the promoters held 39.43% as at

March 31, 2009.

Reserves

The reserves increased by 6% from Rs403

crores to Rs429 crores during the year.

The net addition to reserves was owing

to profits earned during the year.

Loan funds

The reliance on external funds decreased

by 14 % to Rs368 crores. Focused

approach to realise funds blocked with

the Government and in inventories and

debtors helped in reducing debt. Secured

loans constituted 89% of the total loans.

Of the secured loans, 15% was for

funding working capital requirements,

the balance being used in projects.

Foreign currency loans constituted 27%

of the total debt. The Company remained

reasonably geared with the ratio of total

debt to total equity at 0.77:1.

Interest

Interest cost during the year increased

by 25% during the year owing to

higher interest rates and increase in

debt. The average debt cost stood at

8.70% p.a. on March 31, 2009

compared with 8.04% p.a. at the

same time in the previous year.

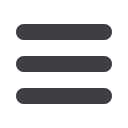

Year

2004-05

2005-06

2006-07

2007-08

2008-09

Debt-equity ratio

1.61

1.20

1.17

0.95

0.77

Interest coverage ratio

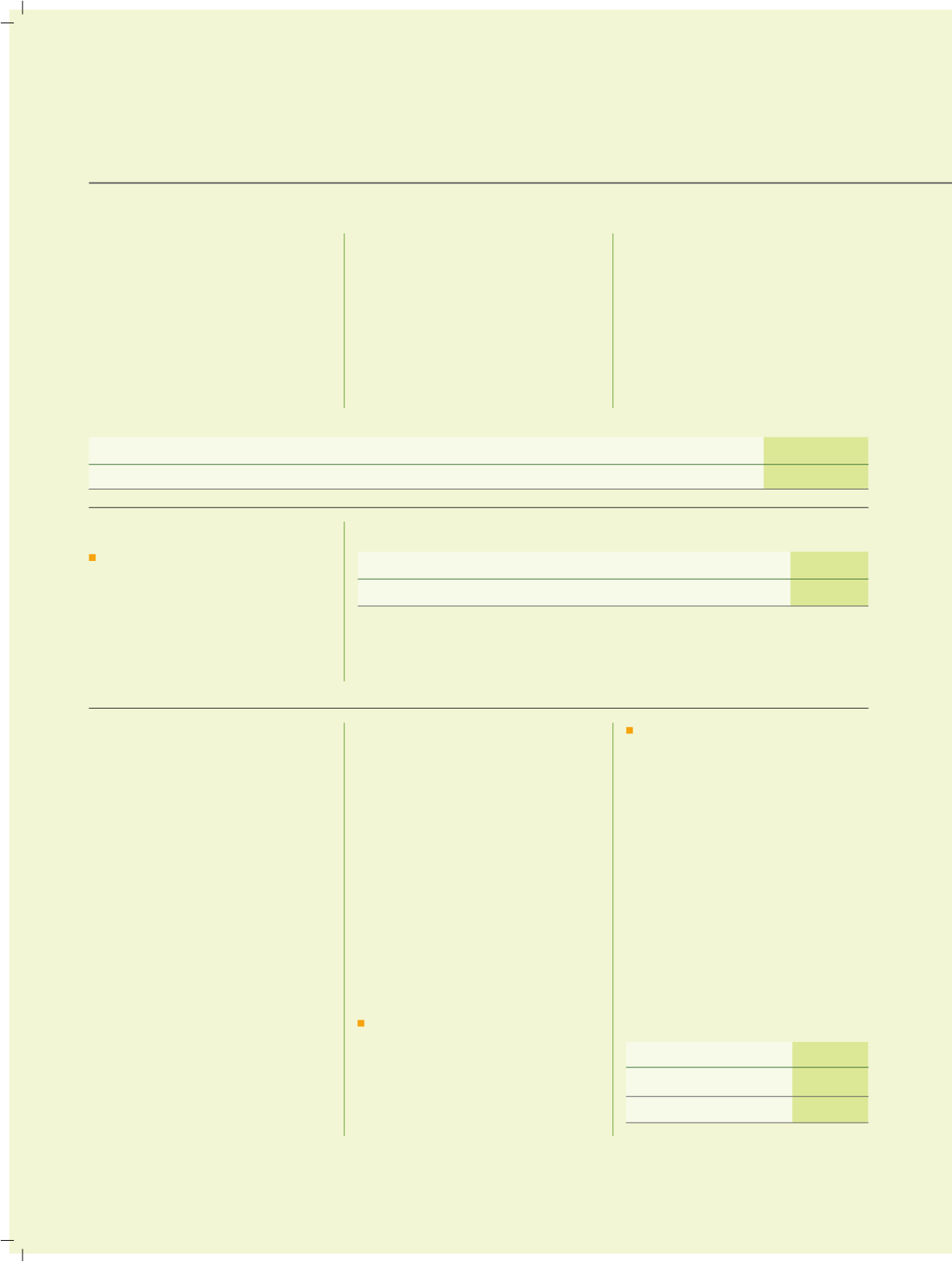

Year

2004-05 2005-06 2006-07 2007-08 2008-09

Interest Coverage

2.98

2.48

2.96

3.06

2.89

Gross block

During the year, gross block increased by

9% to Rs951 crores. Addition to plant

and machinery accounted for Rs72 crores

(77% of the total addition) whereas

addition to buildings accounted for Rs14

crores (15% of the total addition). The

investment in plant and machinery was

owing to the addition of balancing

equipment

(for

de-bottlenecking

capacities) in different Divisions and DDS

project

in

Pharmaceuticals

&

Intermediates Division resulting in

enhanced production.

Depreciation

Depreciation cost increased by 8% over

the previous year, corresponding to the

increase in plant, machinery and

building. Cumulative depreciation as a

part of total gross block was 55%.

Investments

The Company invested its operational

surplus in its business. Other investments

remained more or less unchanged at

Rs65 crores.

Working capital

Working capital outlay decreased from

Rs356 crores at the end of the previous

year to Rs313 crores during the year

mainly due to:

Focussed decrease in the stock of raw

materials by the different businesses,

improved systems, support to maintain

an optimum level of inventories and

introduction of better inventory

management tools

Decrease in debtors through the credit

period reduction and emphasising

timely collection

The efficiency in working capital

management was reflected in an

important fact – despite a significant

growth in business volumes, working

capital outlay as a proportion of the

total employed capital decreased from

41% to 37% during the year. Liquidity

ratios remained at the level of the

previous year, indicating stable short-

term liquidity.

Liquidity ratios

Year

2007-08 2008-09

Current ratio

2.44

2.45

Quick ratio

1.26

1.17