| Annual Report 2008-09

25

Enhanced exports during the year

resulted in increased revenues from

export incentives by 54% to Rs16 crores.

The operating income, which also

includes processing charges and

miscellaneous scrap sales, increased by

1% to Rs6 crores. Other income, which

contributed 1% of the total income,

decreased by 35% over the previous year.

Other income mainly comprised of

dividend and interest income which are

recurring in nature. It was lower

compared with the previous year in

which the Company received a non-

recurring refund paid for coal purchase.

Costs

Total

cost

(excluding

interest,

depreciation and tax) increased by 15%

over the previous year. However, as a

percentage of total income, it decreased

marginally by 0.22%.

Raw materials

Raw materials cost increased, in absolute

terms, by 8% and as a proportion of total

income decreased by 3.64% during the

year. This absolute increase in

consumption was compensated by a

timely revision of the sale price of finished

goods.

Utilities

Utilities cost increased 3% in absolute

terms during the year. However, as a

proportion of total income, they

decreased from 10% in the previous year

to 9% during the year. The Company

took several utility conservation measures

across its operational units.

Employees

Employees cost increased by 13% in

absolute terms mainly on account of new

recruitment and increments | corrections

during the year. Revenues per employee

increased from Rs0.38 crores to Rs0.44

crores during the year.

Margins

The Company registered an improved

profitability at the operating and

net levels. In absolute terms,

EBIDTA increased from Rs100 crores to

Rs118 crores, due to better sales

realisation which was partly offset by

higher raw materials prices and

employees and repairs costs. PBT

increased by 20% to Rs46 crores

compared to the previous year. However,

PAT margin remained stagnant at

3% during the year due to higher

tax payment as compared with the

previous year.

Funds

Equity capital

The equity capital remained unchanged

at Rs29.67 crores, with no equity dilution

during the year. The equity capital

comprised of 2,96,91,780 equity shares

of Rs10 each, of which 6.62%

constituted bonus shares by capitalisation

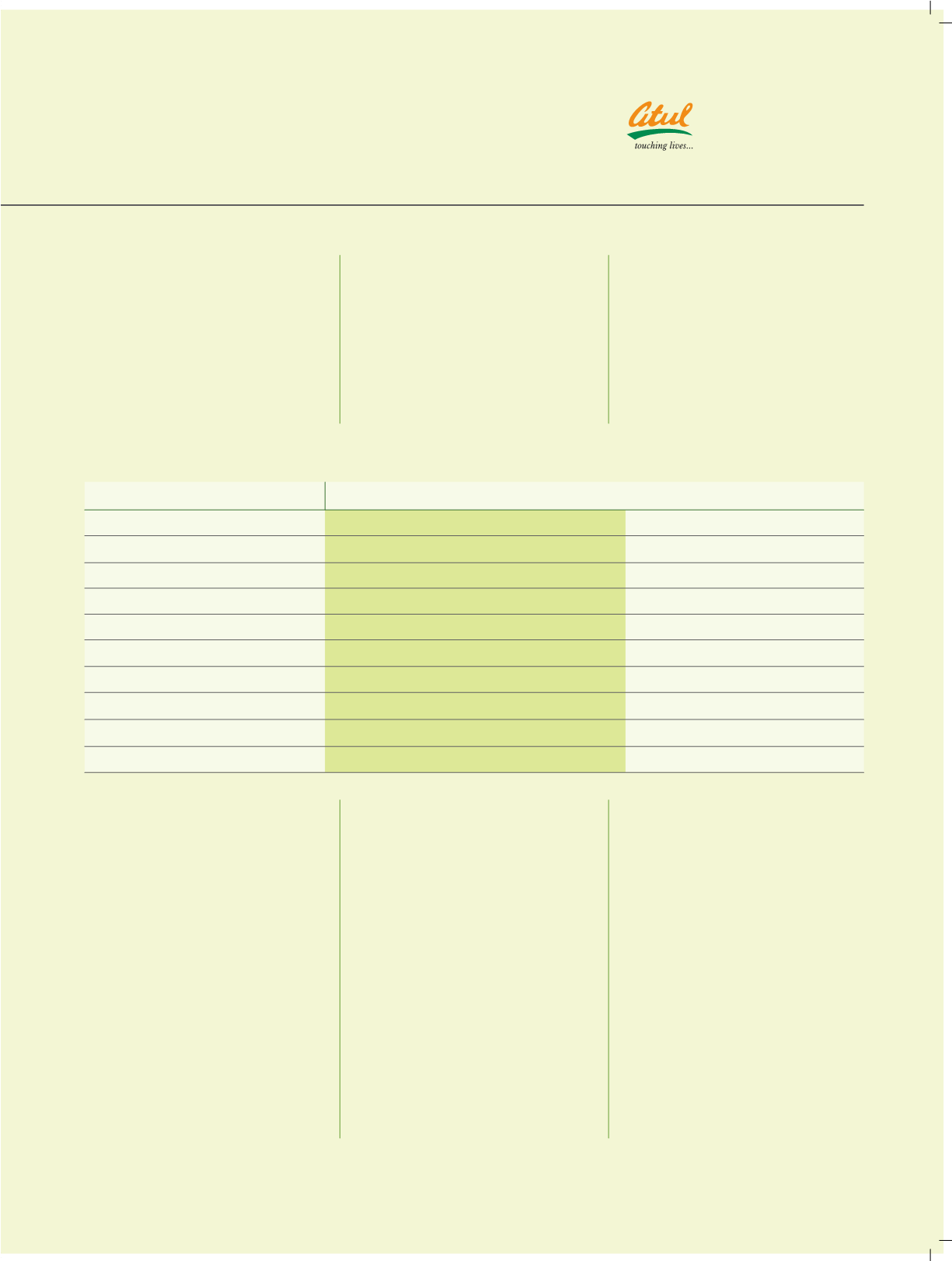

Individual cost heads as a proportion of operational revenues:

Cost heads

% of operating revenues

2008-09

2007-08

Raw materials

52.64

56.28

Power, fuel and water

9.26

10.36

Employees

7.61

7.79

Stores consumed

3.33

3.32

Machinery repairs

3.17

3.05

Building repairs

0.58

0.63

Interest

3.44

3.17

Depreciation

2.66

2.84

Tax

0.64

0.36