28

Directors’ Report

Dear Members,

The Board of Directors of Atul Ltd present the Annual Report of the Company together with the audited statement of accounts for

the year ended March 31, 2009.

Dividend

The Board of Directors of the Company

recommend payment of dividend of Rs3

per share on 2,96,61,733 equity shares

of Rs10 each fully paid up. The dividend

will entail an outflow of Rs10.41 crores

on the paid-up equity share capital of

Rs29,66,17,330.

Profitability

The sales and operating income at

Rs1,181.10 crores recorded a growth of

17% (previous year 11%). All businesses

recorded higher sales, aided mainly by

robust demand particularly in the first

half of the year and on account of higher

realisation on exports due to weak Re.

The operations showed improved

profitability evident from the rise in PBT

from Rs28.15 crores to Rs89.73 crores,

before considering the exchange rate

difference. After considering the

exchange rate difference, however, the

PBT increased from Rs38.17 crores to

Rs45.69 crores.

Finance

The interest and finance charges (net) for

the year were Rs41.03 crores compared

to Rs32.73 crores during the previous

year-an increase of 25.34% as compared

to the sales growth of only 16.22%. The

net interest to sales ratio, as a result,

increased from 3.28% last year to 3.47%.

During the year, the benchmark interest

rates continued to rise and PLRs of banks

showed a significant upward bias for

most part of the year (however, they

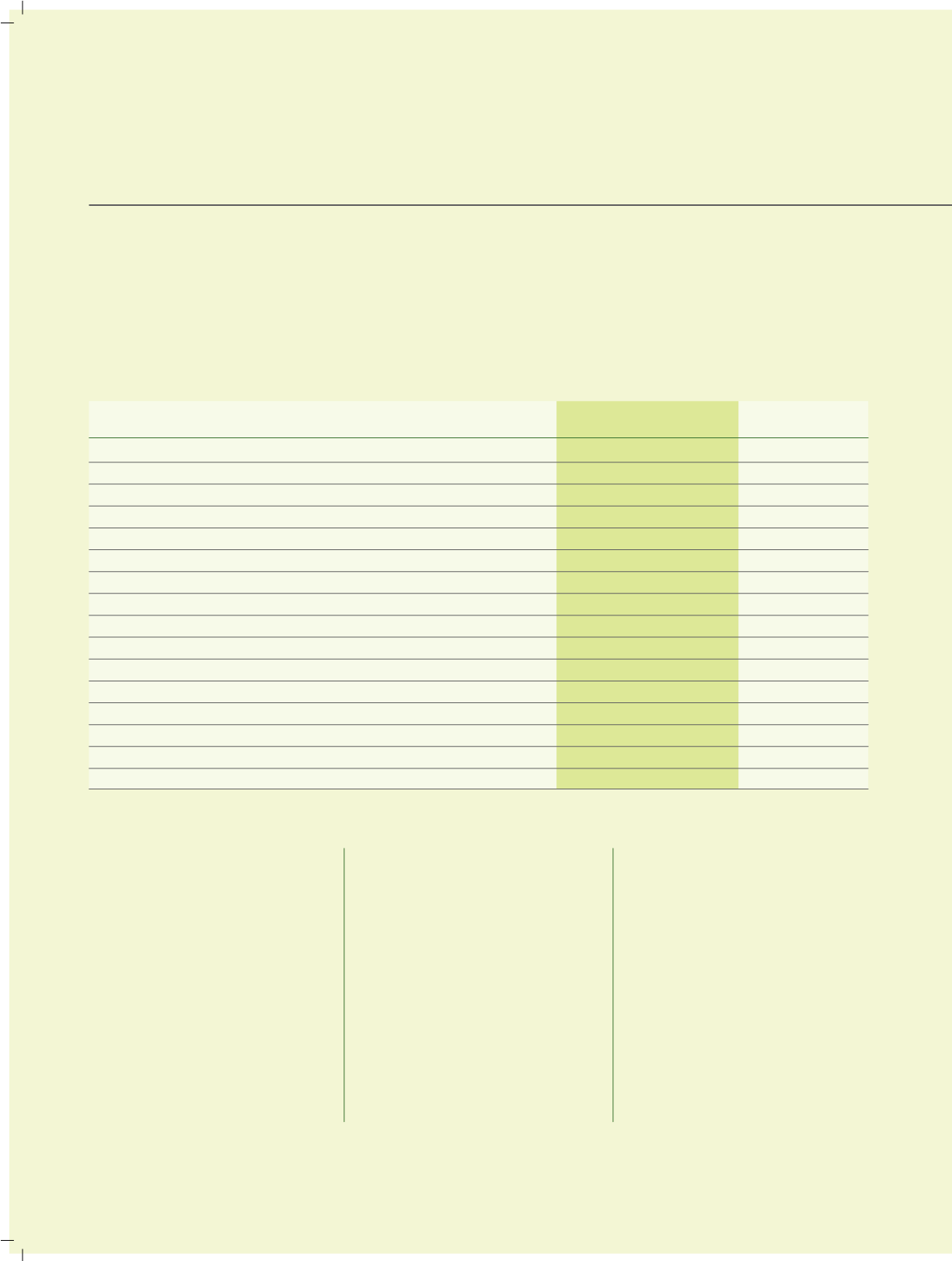

Financial results

2008-09

2007-08

Sales and operating income

1,18,110

1,01,368

Other income

1,285

1,962

Total revenues

1,19,395

1,03,330

Profit before tax and exchange rate difference

8,973

2,815

Exchange rate difference income | (expense)

(4,404)

1,002

Profit before tax

4,569

3,817

Taxation including tax adjustment and MAT entitlement

782

155

Net profit after tax

3,787

3,662

Balance brought forward

20,375

18,120

Disposable surplus

24,162

21,782

Appropriation

General reserve

379

366

Proposed dividend

890

890

Dividend tax on above

151

151

Balance carried forward

22,742

20,375

24,162

21,782

(Rs in lacs)